Tuesday, December 22nd, 2020 and is filed under AI Insight News

AI Insight CEO Sherri Cooke discusses her key reflections for 2020 including how alternative investments played an important role in portfolios and the impacts of Reg BI. She also shares what’s anticipated in 2021. Read the narrative below or listen to the podcast here.

Sherri formed AI Insight in 2005 with the primary goal of providing the financial planning community with a more efficient and consistent way to access factual information on alternative investment programs – and from that vision the AI Insight database was born.

Q: What are some of the key reflections you have about 2020 and some points of interest for the coming year?

SC: I would say as a ADISA Board member, I was fortunate to be able to spend quite a bit of time this year collaborating with others in the alternative investment industry focusing on some of the things we can do to make the industry better – and to increase the awareness and understanding of these products within a growing audience. I believe we all have to work together to bring this space to a whole new level. Also, as Reg BI requirements continue, we’re looking at ways to partner with compliance and technology workflow companies that are helping to support these needed processes. We’re also looking to connect with other companies – both inside and outside the traditional alternatives space to further increase consistency and transparency in the industry with an ultimate goal of making it easier to conduct alts business.

Q: How do you think alternative investments played an important role in portfolios this past year, especially given the pandemic?

SC: We’re always looking for ways to give more to people – who are of course qualified – access to alternative investments to help them really diversify their portfolio in a meaningful way. Our belief is that a person isn’t fully diversified if all of their underlying investments are either in some way tied to the markets or are invested in a fixed income security – which is effectively still tied to the market.

Despite the pandemic – and in some cases as a result of – there are a lot of really solid opportunities to invest in real assets, interesting investment structures, and institutionally supported opportunities through alternative investments that really provide true diversification.

That said, alternatives can certainly be complex and they need to be factually understood and appropriately sold. This industry really needs to educate financial professionals and investors in so many different ways. One of those has to be around creating realistic expectations about what these investments are intended to bring to a diversified investment portfolio…and what they are not. Stocks lose value all the time and there will be alts that don’t perform. As an industry, we really need to do our very best to ensure that these products are properly sold and positioned within client portfolios. And – as with all investments – we support conducting the best possible research and diligence to allow firms and advisors to select best of class – and help the vested financial firms and producers drive product sponsors toward best of class practices.

Q: We know that compliance is often an issue for advisors in considering alternative investments – and regulatory scrutiny continues to increase. The SEC’s Regulation Best Interest implementation took place on June 30. How does AI Insight help streamline Reg BI requirements?

SC: Compliance is one of the things that motivated me to create AI Insight in the first place. I wanted to build capabilities to facilitate due diligence and proper compliance along with education and documentation of these efforts when selling complex products – those products that the regulators have called out as needing heightened supervision or training.

From an audit perspective, we’ve found in any situation of which we’re aware with our clients, if a firm has stayed up-to-date on the requirements around selling different types of investments – and makes sure everyone involved is aware of their obligations, adheres to the processes, and documents their efforts – then the regulators are generally satisfied. If you fail to make these efforts up front and you’re inconsistent in how you conduct your business from a compliance perspective….you’re just leaving yourself open to trouble.

Reg BI – within the BD community – and I think even though the fiduciary standard has always applied RIA space – we’re going see a whole new layer of extra scrutiny in this regard. The processes that have been central to our platform for years can help support Reg BI requirements and help financial firms and professionals demonstrate the “good faith and reasonable efforts” that Reg BI requires on an ongoing basis. Specifically, we’ve created a comprehensive Reg BI Guide that steps through the Compliance and Care Obligations and correlates the AI Insight support resource to that particular SEC requirement. Again, this is just another way that we help to create efficient and consistent educational and compliance workflows that can help firms at both the product and the firm level.

Q: What is your focus for 2021?

SC: From a business owner’s perspective, ensuring that our team and our product continues to maintain consistent integrity of value and exceptional service; this is the backbone of our business – and making sure that our AI Insight team is challenged and fulfilled in their roles within our company.

From an industry perspective – we believe that there is a tremendous amount of value for advisors to differentiate themselves and bring really great opportunities through the thoughtful and diligent understanding of alternative products. We provide this value by building and bringing together our network of broker-dealers, advisors, RIAs, alternative investment firms and industry partners. Therefore, as in past years, I am always grateful for how far we’ve been able to come and to everyone who has helped us be successful in our efforts to support this industry – and I look forward to working with all of our business partners to explore new possibilities and find what more we can bring to the table for our customers in the new year.

Tuesday, December 8th, 2020 and is filed under Industry Reporting

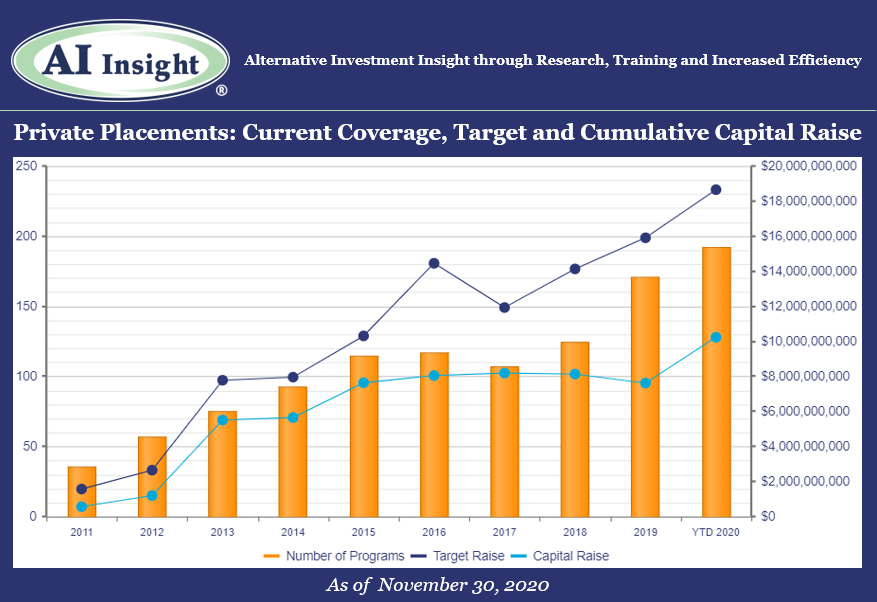

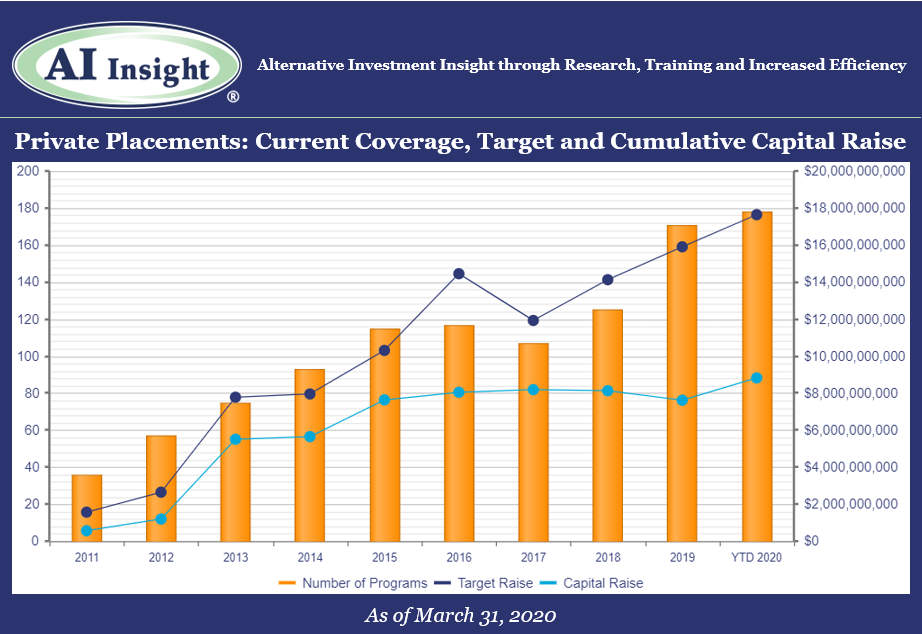

We recently released our November Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

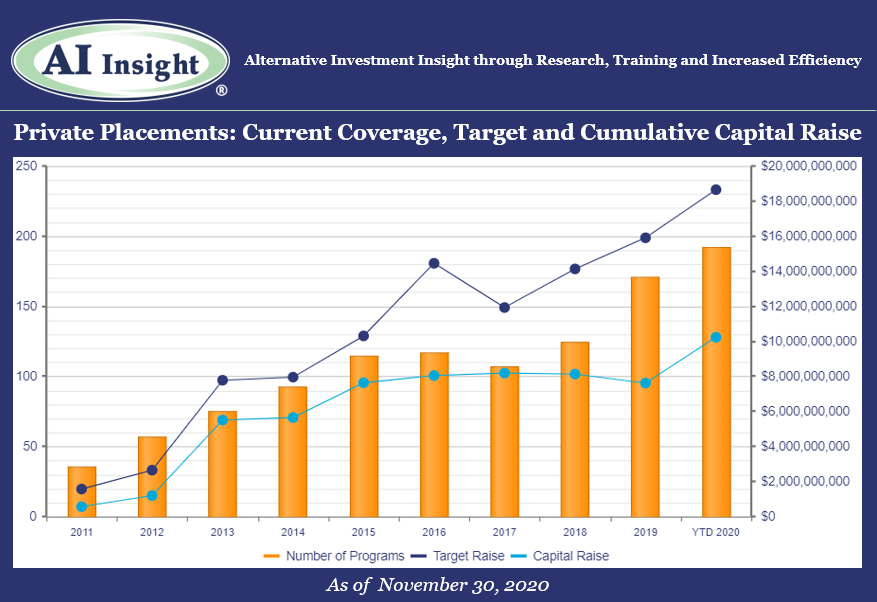

- Private placement fund activity slowed in November although it remains well above the mid-year COVID-19 slowdown. Year-over-year our coverage is down (-4% in new funds and -7% in target raise), especially on the real estate side, while some of the smaller areas of our coverage have increased. Energy, preferred, and private equity/ debt offerings are way up with strategies focused on opportunities created by the COVID-19 market dislocation. The 170 funds added in 2020 were offered by 69 separate sponsors.

- As of December 1st, AI Insight covers 192 private placements currently raising capital, with an aggregate target raise of $18.6 billion and an aggregate reported raise of $10.2 billion or 55% of target.

- Real estate-related funds, including 1031s, opportunity zones, and non-1031 real estate LLCs and LPs represent the largest component of our private placement coverage, at 68% of funds and 59% of target raise. Private equity/debt funds represent a relatively small amount of our coverage in terms of the number of funds at only 9%, but tend to be larger and represent 29% of aggregate target raise.

- In terms of our coverage by general objective, income is the largest component at 51% of funds, while growth and growth & income follow at 30% and 18%, respectively.

- The average size of the funds currently raising capital is $97.1 million, ranging from $1.9 million for a preferred offering to $3.0 billion for a sector specific private equity/debt fund.

- 75% of private placements we cover use the 506(b) exemption, 12% use 506(c) and 13% have not yet filed their Form D with the SEC.

- 17 private placements closed in November, with roughly 83% meeting or exceeding their target raise. 157 funds have closed year-to-date, having been on the market for an average of 330 days and reporting they raised 69% of their target on average. 85% met or exceeded targets, and only 10% were able to raise less than half of their target. Four funds did not report a raise.

- Seven private placements suspended offerings and one terminated due to uncertainties related to COVID-19.

- ON DECK: as of December 1st, there were eight new private placements coming soon.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs, Interval Funds, and Alternative Strategy Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of November 30, 2020, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright ©2020 AI Insight. All Rights Reserved.

Tuesday, November 10th, 2020 and is filed under Industry Reporting

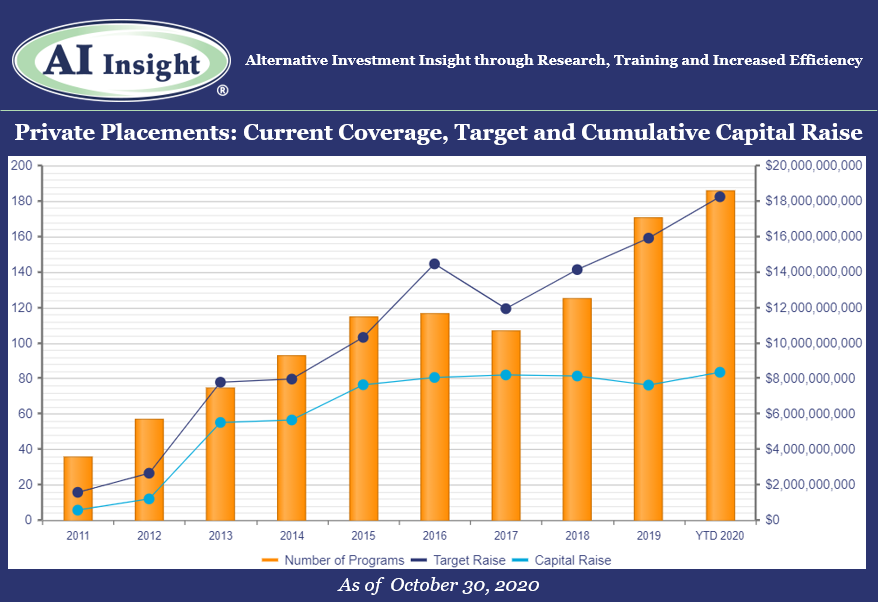

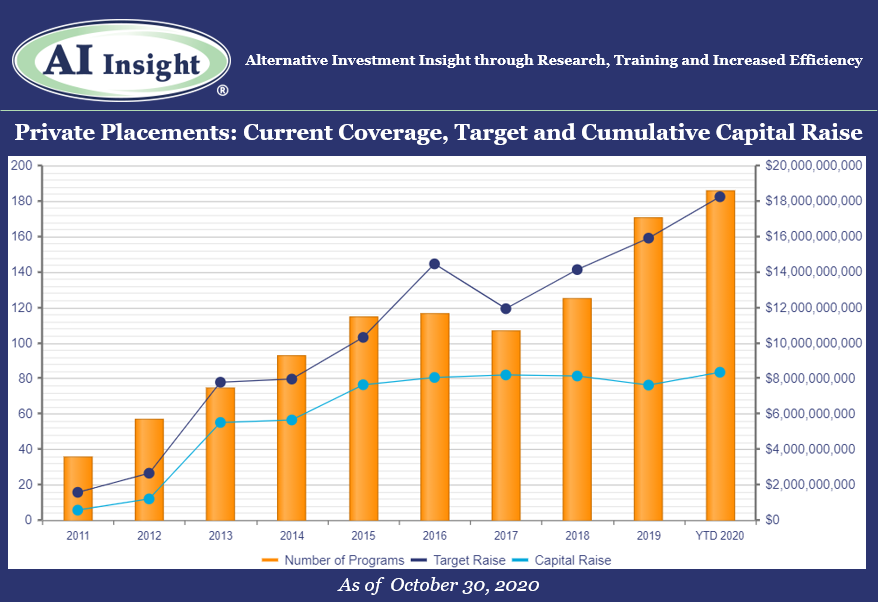

We recently released our October Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- Private placement fund activity continued its strong pace in October, with more funds added to our coverage in the month than any since March. 26 new funds were added in October, led primarily by real estate funds but also including energy, private equity/debt, and preferred offerings.

- As of November 1st, AI Insight covers 186 private placements currently raising capital, with an aggregate target raise of $18.2 billion and an aggregate reported raise of $8.34 billion or 46% of target.

- Real estate-related funds, including 1031s, opportunity zones, and non-1031 real estate LLCs and LPs represent the largest component of our private placement coverage, at 72% of funds and 59% of target raise. Private equity/debt funds represent a relatively small amount of our coverage in terms of the number of funds at only 10%, but tend to be larger and represent 29% of aggregate target raise.

- In terms of our coverage by general objective, income is the largest component at 52% of funds, while growth and growth & income follow at 28% and 19%, respectively.

- The average size of the funds currently raising capital is $98.0 million, ranging from $3.5 million for a single asset real estate fund to $2.8 billion for a sector specific private equity/debt fund.

- 74% of private placements we cover use the 506(b) exemption, 13% use 506(c) and 13% have not yet filed their Form D with the SEC.

- 18 private placements closed in October, with roughly 70% meeting or exceeding their target raise. 137 funds have closed year-to-date, having been on the market for an average of 339 days and reporting they raised 68% of their target on average. 72% met or exceeded targets, and only 16% were able to raise less than half of their target.

- Seven private placements suspended offerings and one terminated due to uncertainties related to COVID-19.

- ON DECK: as of November 1st, there were seven new private placements coming soon.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs, Interval Funds, and Alternative Strategy Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of October 31, 2020, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright ©2020 AI Insight. All Rights Reserved.

Tuesday, October 6th, 2020 and is filed under Industry Reporting

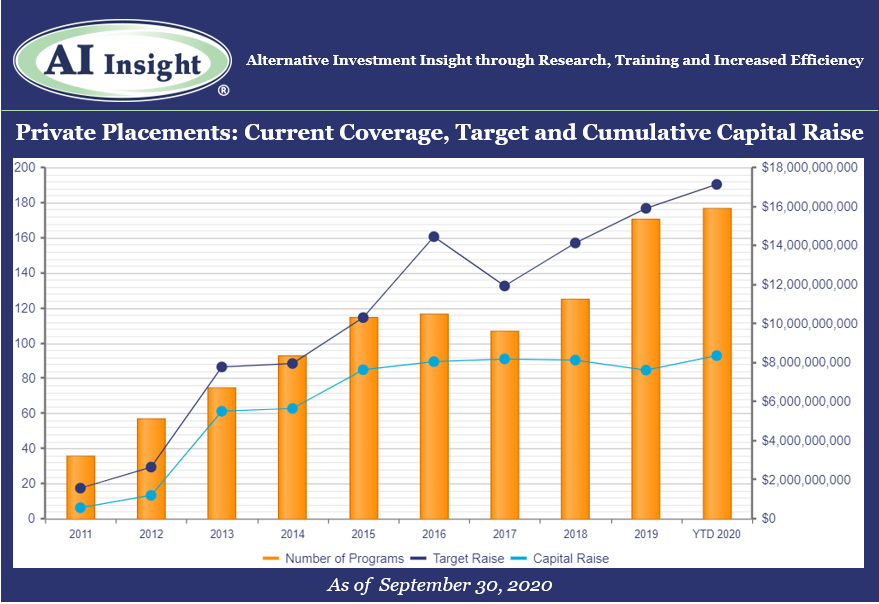

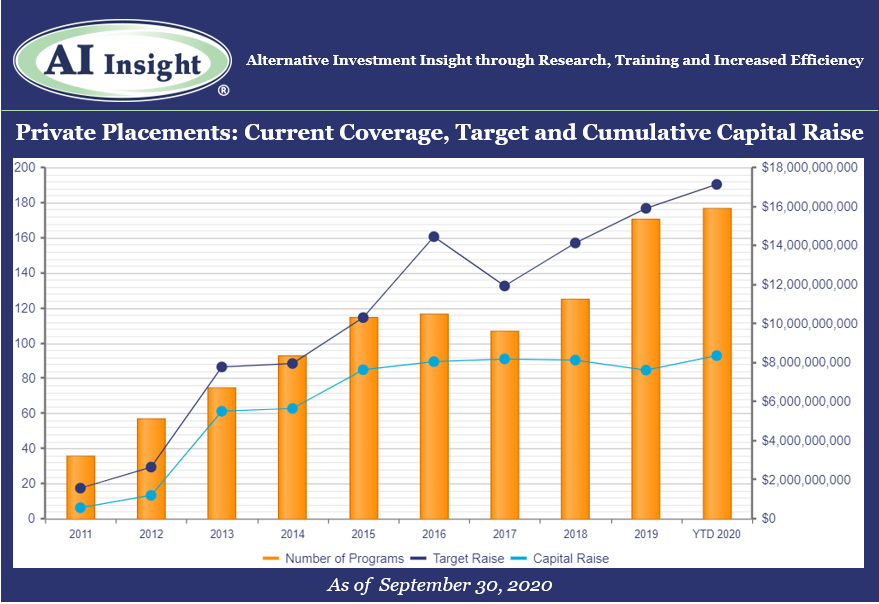

We recently released our September Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- Private placement fund activity ramped up in September, with more funds added to our coverage in the month than any since March. 19 new funds were added in September, led by 1031s, energy, and non-1031 real estate.

- As of October 1st, AI Insight covers 177 private placements currently raising capital, with an aggregate target raise of $17.1 billion and an aggregate reported raise of $8.4 billion or 49% of target.

- Real estate-related funds, including 1031s, opportunity zones, and non-1031 real estate LLCs and LPs represent the largest component of our private placement coverage, at 72% of funds and 60% of target raise. Private equity/debt funds represent a relatively small amount of our coverage in terms of the number of funds at only 9%, but tend to be larger and represent 27% of aggregate target raise.

- In terms of our coverage by general objective, income is the largest component at 52% of funds, while growth and growth & income follow at 29% and 18%, respectively.

- The average size of the funds currently raising capital is $96.8 million, ranging from $3.5 million for a single asset real estate fund to $2.8 billion for a sector specific private equity/debt fund.

- 76% of private placements we cover use the 506(b) exemption, 15% use 506(c) and 10% have not yet filed their Form D with the SEC.

- 11 private placements closed in September, with all either meeting or exceeding their target raise. 120 funds have closed year-to-date, having been on the market for an average of 333 days and reporting they raised 62% of their target on average.

- Seven private placements suspended offerings and one terminated due to uncertainties related to Covid-19.

- ON DECK: as of October 1st, there were seven new private placements coming soon.

- Listen to the companion podcast for this blog.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs, Interval Funds, and Alternative Strategy Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of September 30, 2020, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright ©2020 AI Insight. All Rights Reserved.

Wednesday, September 2nd, 2020 and is filed under Industry Reporting

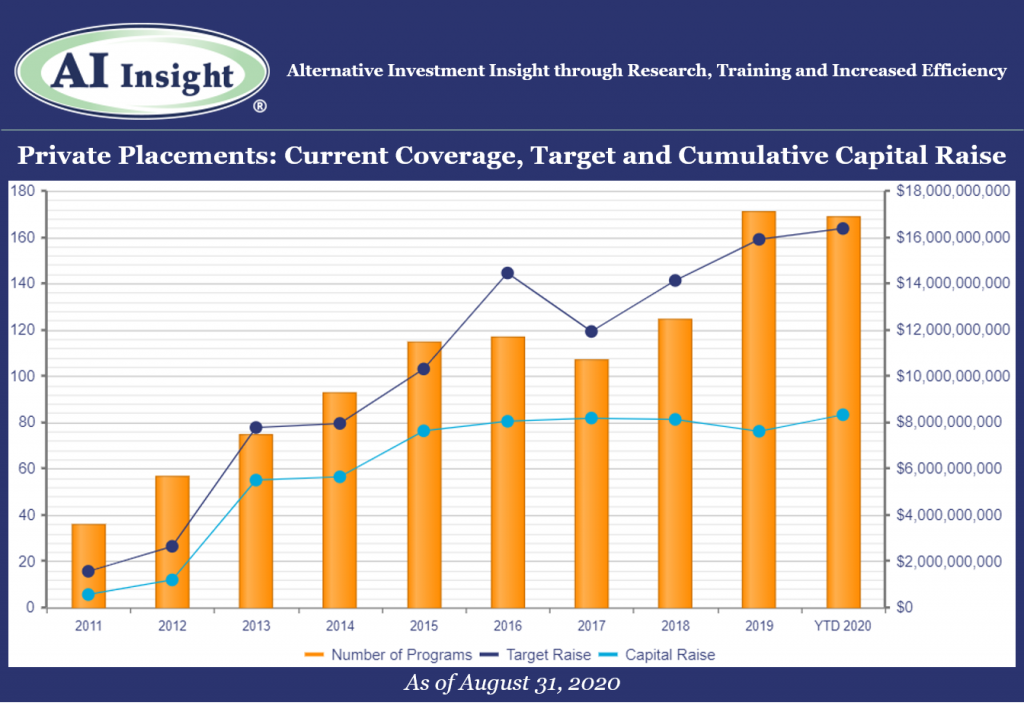

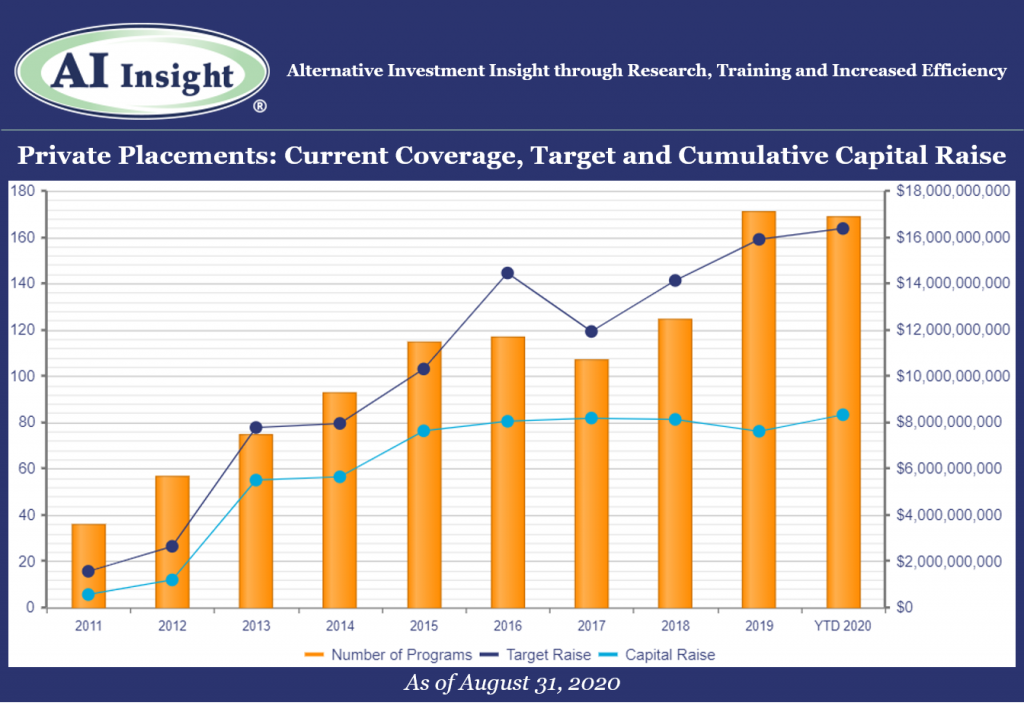

We recently released our August Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- Private placement fund activity remained steady in August. However, our coverage remains down year-over-year after an anemic spring.

- Thirteen new funds were added to our coverage in August, on par with the last couple of months but well below the 20 or more funds added each month in 2019. Our coverage is down 10.53% in terms of new funds added year-over year, and 28.26% in terms of the aggregate target raise. Fewer funds have been added and they’ve been targeting less capital.

- As of September 1st, AI Insight covers 169 private placements currently raising capital, with an aggregate target raise of $16.4 billion and an aggregate reported raise of $8.3 billion or 51% of target.

- Real estate-related funds, including 1031s, opportunity zones, and non-1031 real estate LLCs and LPs represent the largest component of our private placement coverage, at 73% of funds and 60% of target raise. Private equity/debt funds represent a relatively small amount of our coverage in terms of the number of funds at only 9%, but tend to be larger and represent 28% of aggregate target raise.

- In terms of our coverage by general objective, income is the largest component at 52% of funds, while growth and growth & income follow at 29% and 18%, respectively.

- The average size of the funds currently raising capital is $96.9 million, ranging from $3.5 million for a single asset real estate fund to $2.8 billion for a sector specific private equity/debt fund.

- 76% of private placements we cover use the 506(b) exemption, 15% use 506(c) and 10% have not yet filed their Form D with the SEC.

- 12 private placements closed in August, having raised approximately 57% of their target and having been on the market for an average of 292 days. 109 funds have closed in 2020, having raised 64% of their target. 67% of funds that closed this year met or exceeded their target.

- Five private placements suspended offerings and one terminated due to uncertainties related to Covid-19.

- ON DECK: as of September 1st, there were four new private placements coming soon.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, Non-Traded BDCs, Interval Funds, and Alternative Strategy Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of August 31, 2020, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright ©2020 AI Insight. All Rights Reserved.

Monday, July 6th, 2020 and is filed under Industry Reporting

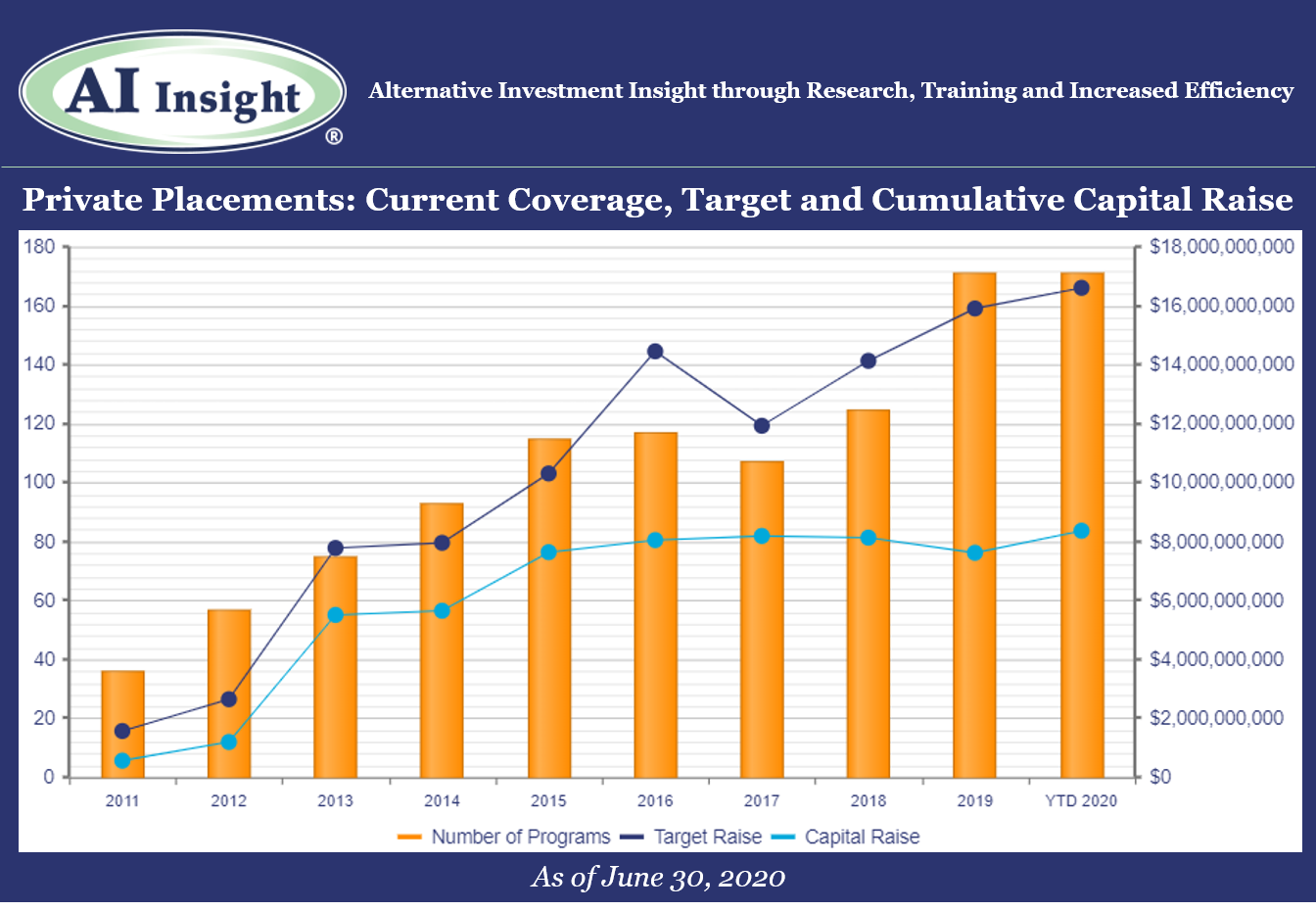

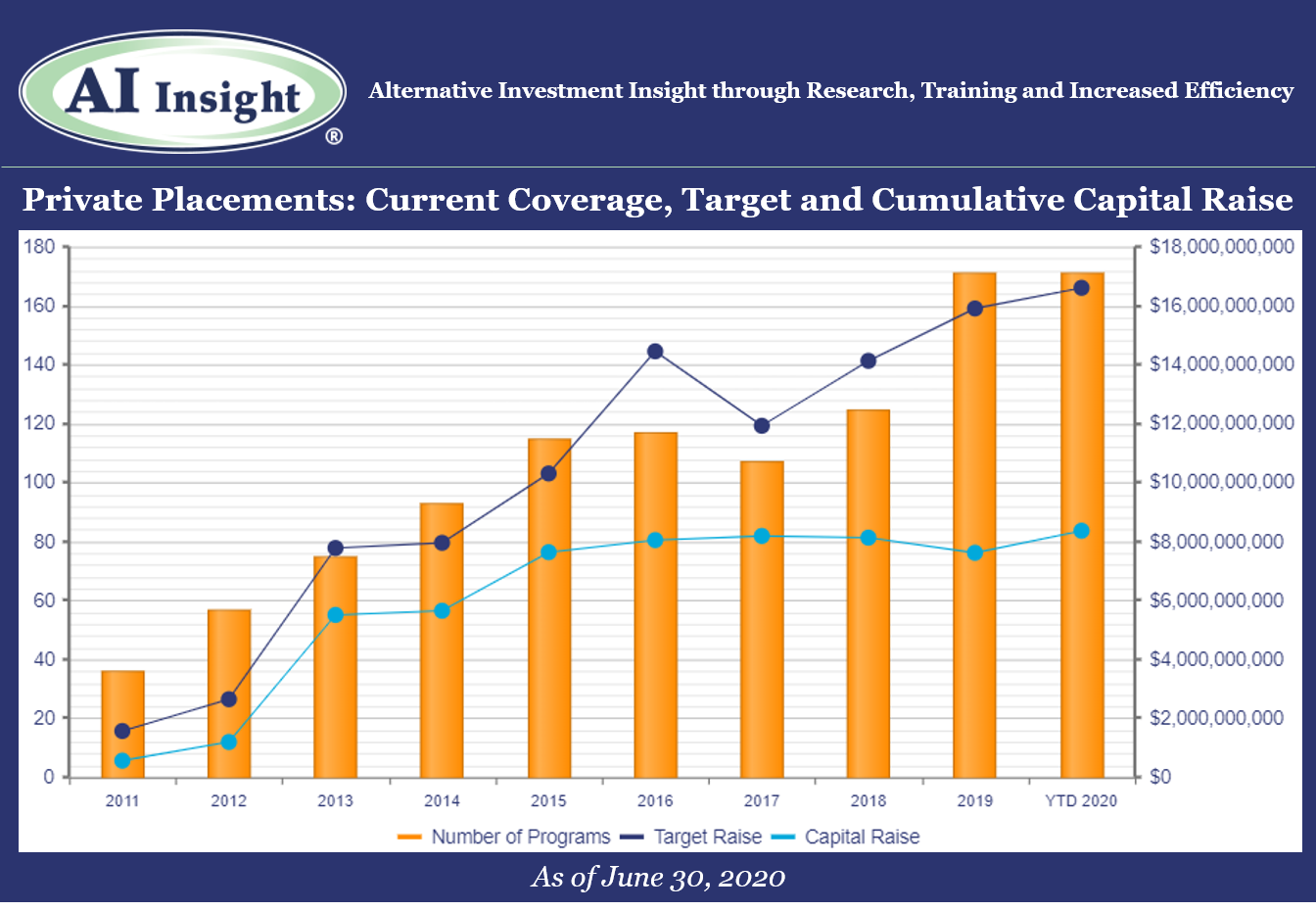

We recently released our June Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- After a slow couple of months, private placement fund formation accelerated in June, led by stronger activity in 1031s and the addition of distressed funds in the wake of the COVID-19 market disruption.

- As of July 1st, AI Insight covers 171 private placements currently raising capital, with an aggregate target raise of $16.6 billion and an aggregate reported raise of $8.4 billion or 51% of target. The average size of the current funds is $97.1 million, ranging from $3.5 million for a single asset real estate fund to $2.7 billion for a sector specific private equity/debt fund.

- 13 private placements closed in June, having raised approximately 65% of their target and having been on the market for an average of 408 days. 88 funds have closed in 2020, having raised 67% of their target.

- Five private placements suspended offerings and one terminated due to uncertainties related to COVID-19.

- ON DECK: as of July 1st, there were three new private placements coming soon, all opportunity zone funds (QOZs) as the category ramps back up with further regulatory guidance.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, BDCs, Interval Funds, and Alternative Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of June 30, 2020, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright ©2020 AI Insight. All Rights Reserved.

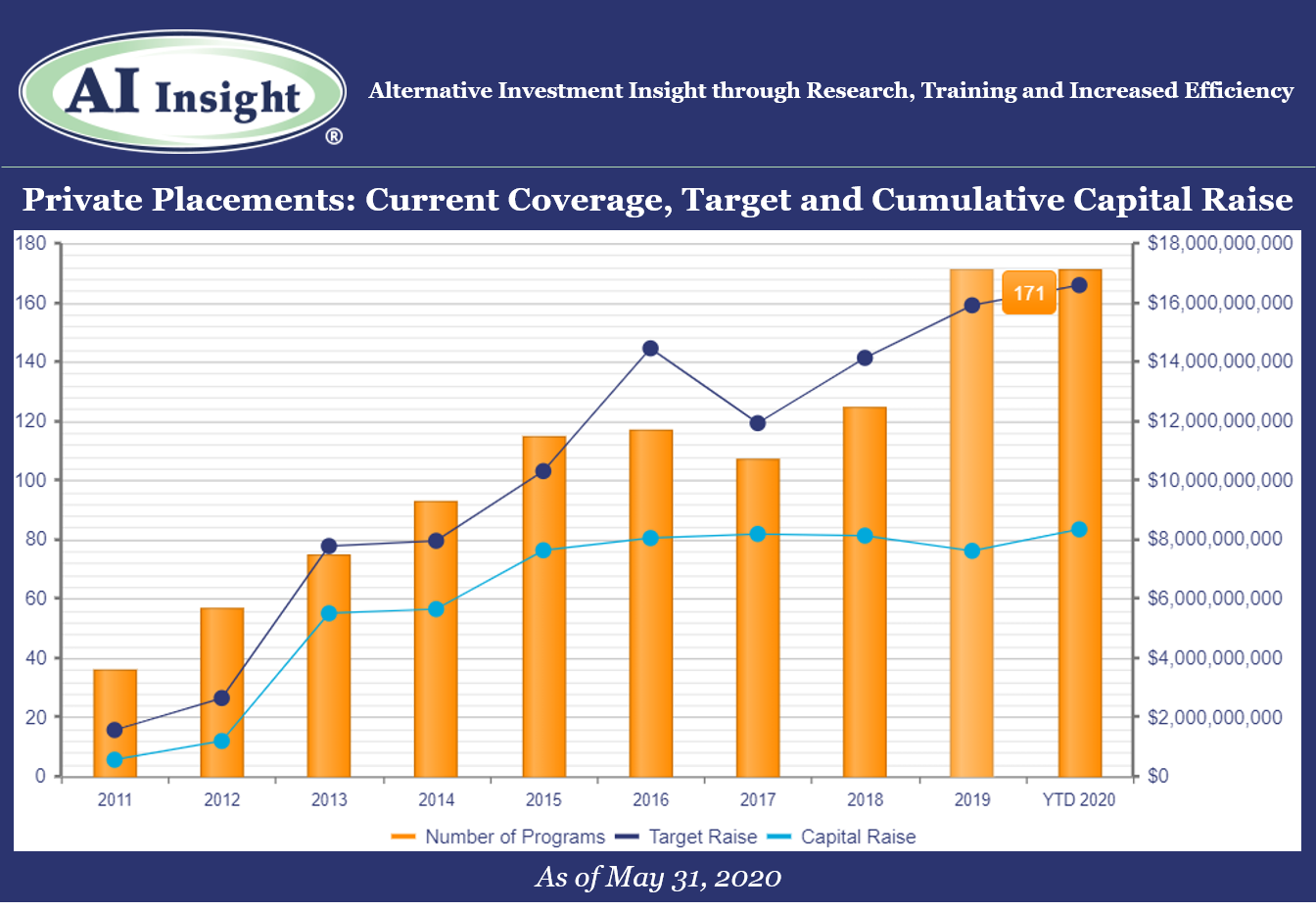

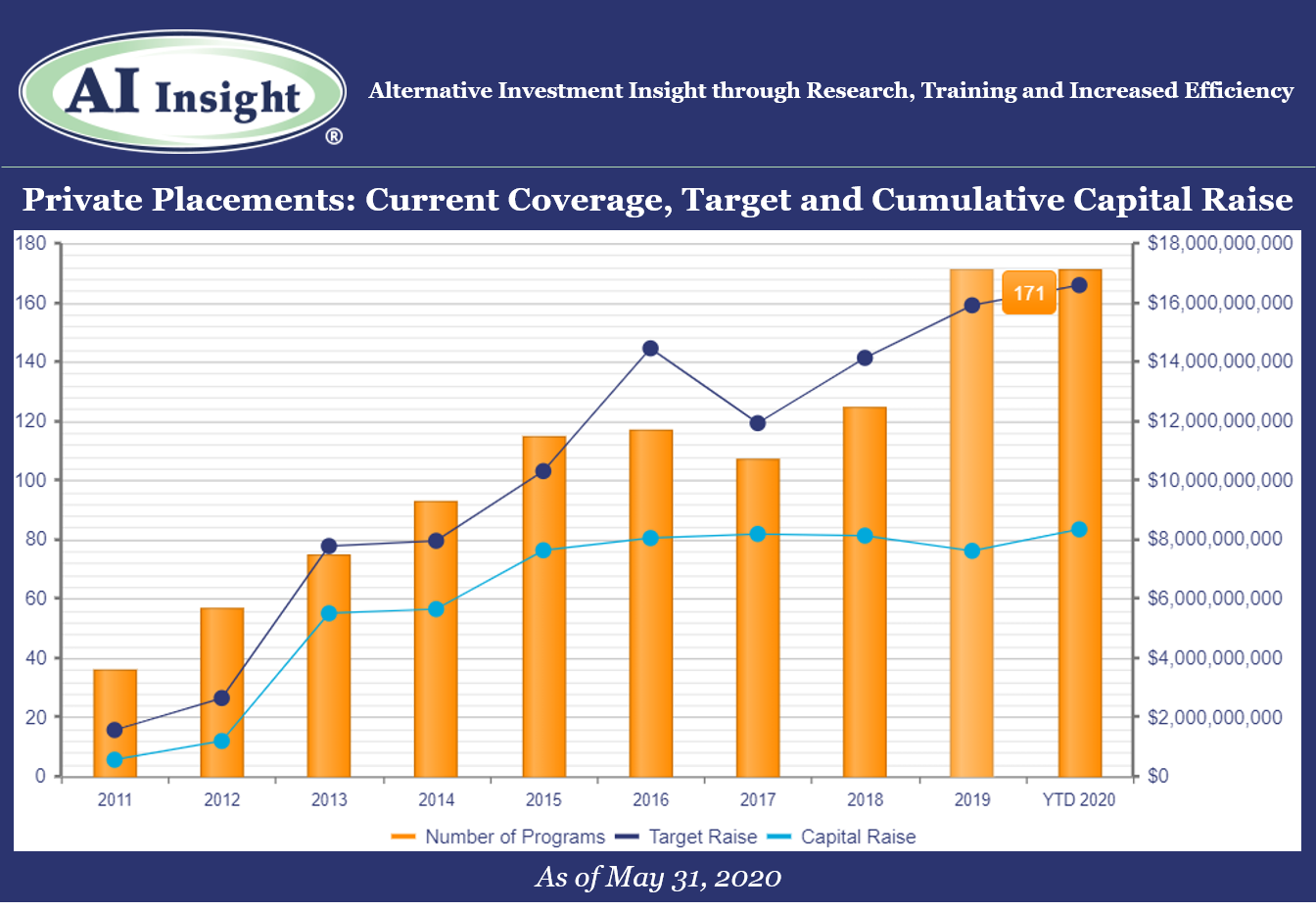

Monday, June 8th, 2020 and is filed under Industry Reporting

We recently released our May Private Placement Insights report. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- Private placement fund formation has slowed in the wake of COVID-19. Eight new private placements were added to our coverage in May, roughly half of the monthly level we’ve seen on average over the last few years. The first few months of 2020 were strong but with the slowdown in May, we are now flat in terms of new funds added to over coverage year-over-year and down modestly in aggregate target raise.

- The slowdown was most visible in the 1031 category, where only four new funds were added to our coverage in May compared to well over double digit additions for the last several years. This may be partially due to a slowdown in real estate transactions overall as well as a lack of confidence in valuations. Also, fewer highly appreciated properties are being sold right now, which reduces the demand for 1031 exchanges at least in the near-term. The consensus in the industry is that demand will accelerate once transaction activity resumes and valuations are more reliable.

- We are seeing more activity this year in preferred securities and private equity/debt funds, and we are also starting to see sector-specific opportunistic funds ramp up in the wake of the COVID-19 market disruption. Opportunity zone (QOZ) funds, which had paused for several months, are back on track with three in the queue to be added to our coverage soon. Recent events around the US could continue to highlight the importance of QOZ strategies.

- As of June 1st, AI Insight covers 171 private placements currently raising capital, with an aggregate target raise of $16.6 billion and an aggregate reported raise of $8.3 billion or 50% of target. The average size of the current funds is $97.0 million, ranging from $3.5 million for a single asset real estate fund to $2.7 billion for a sector specific private equity/debt fund.

- 14 private placements closed in May, having raised approximately 52% of their target and having been on the market for an average of 336 days.

- Five private placements suspended offerings due to uncertainties related to COVID-19.

- ON DECK: as of June 1st, there were four new private placements coming soon.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, BDCs, Closed-End Funds, and Alternative Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of May 31, 2020, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright ©2020 AI Insight. All Rights Reserved.

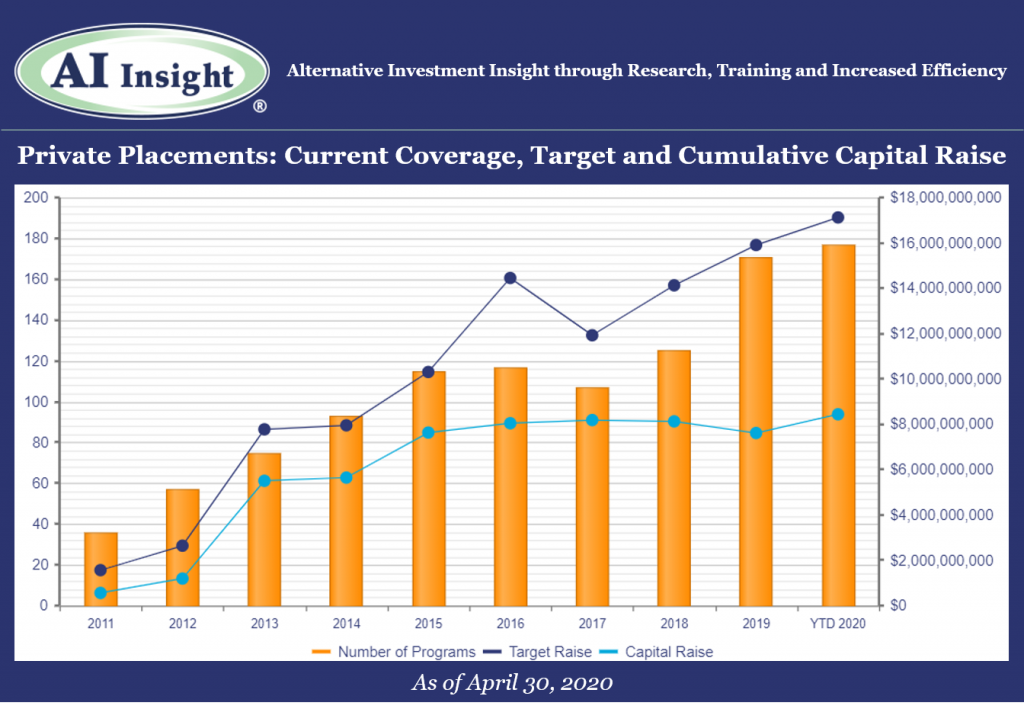

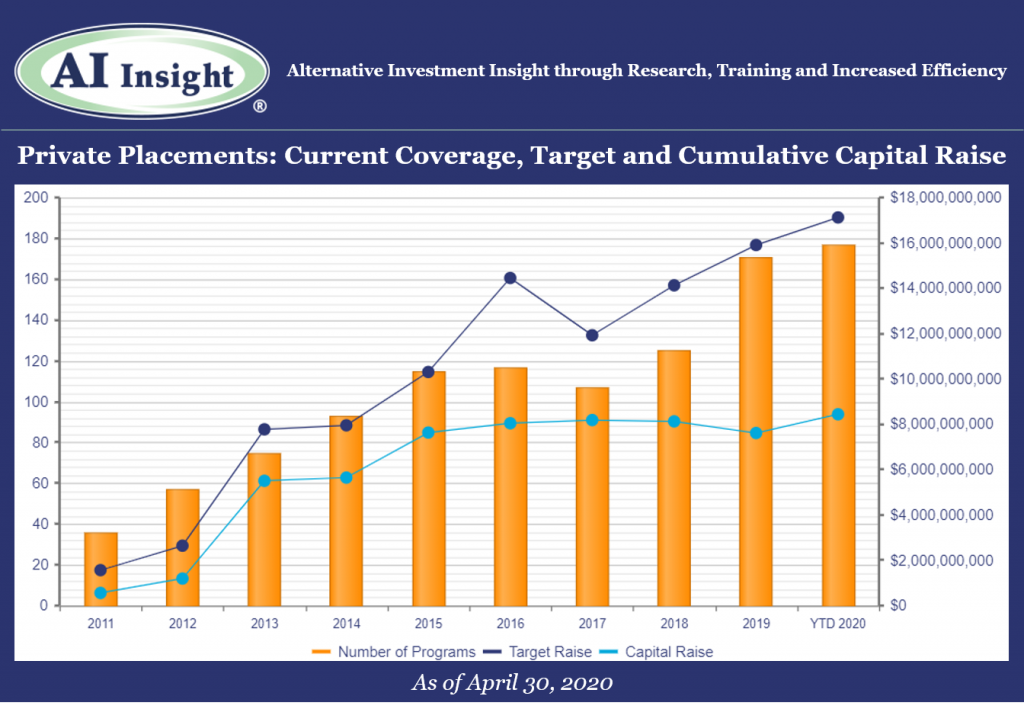

Thursday, May 7th, 2020 and is filed under Industry Reporting

We recently released our April Private Placement Insights. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

- 10 new private placements were added to our coverage in April, ahead of last year’s levels on a YTD basis but below the last couple of months. The industry is still led by real estate funds including 1031s and real estate LPs and LLCs, although 1031s have slowed significantly.

- As of May 1st, AI Insight covers 177 private placements currently raising capital, with an aggregate target raise of $17.1 billion and an aggregate reported raise of $8.4 billion or 49% of target. The average size of the current funds is $96.7 million, ranging from $3.5 million for a single asset real estate fund to $2.5 billion for a sector specific private equity/debt fund.

- 12 private placements closed in April, having raised approximately 63% of their target and having been on the market for an average of 422 days. Two private placements suspended offerings due to uncertainties related to COVID-19.

- ON DECK: as of May 1st, there were three new private placements coming soon.

Private Market Update: COVID-19

- According to a recent report by Preqin, COVID-19 has disrupted the private capital markets significantly across all categories.

- Fewer private equity funds met their target fundraising goals and were able to close in Q1 versus prior quarters. Many had established high fundraising targets prior to COVID-19.

- Private equity fundraising was actually up year-over-year, with the largest and most established funds securing the majority of capital raised.

- Fewer private equity transactions were completed as managers held off on M&A activity anticipating that asset prices would fall in a recession.

- The level of dry powder in the private equity industry is at a record $1.4 trillion as of April 2020. Additionally, 2019 vintage funds, which were originally projected to underperform prior vintages, are now more likely to outperform given the drop in asset prices.

- Private debt fundraising declined in Q1. Direct lending and special situations funds accounted for the majority of fundraising within the category.

- Private real estate fundraising fell in Q1 2020. Managers raised $81 billion from 51 funds versus $51 billion from 83 funds in Q1 2019.

- Private real estate transactions also declined year-over-year, with 1,797 deals completed in Q1 2020 compared to 2,417 deals in Q1 2019.

- Within the real assets category, infrastructure and natural resource fundraising actually increased, and the volume of infrastructure transactions was in line with the prior year. Energy slowed significantly, while social infrastructure sectors such as telecom actually saw increases in fundraising and deal activity.

- Hedge fund launches have stalled from prior months, especially in the equity strategy sector. This makes sense given the recent downturn, although most hedge fund categories performed as expected. The Preqin All Strategies Hedge Fund benchmark declined 10.38% in Q1 2020, compared to the 20% loss in the S&P 500 Index.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, BDCs, Closed-End Funds, and Alternative Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of April 30, 2020, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright ©2020 AI Insight. All Rights Reserved.

Wednesday, April 29th, 2020 and is filed under Alternative Strategy Mutual Funds

Introduction

As the dust settles from the Corona Market, albeit perhaps temporarily, it is prudent to revisit one’s portfolio and assess the effectiveness of your asset allocation. Diversification is an important component to risk management, and at no time is this better tested than during an equity selloff. Beyond the traditional stock and bond allocation, alternative investments can be an effective way to accomplish this. Broadly speaking, the asset class is designed to provide alternative sources of return to traditional market beta and provide the potential for capital preservation during market drawdowns. As such, it is good to assess the performance of alternatives during these periods to see if the hypothesis holds. Specifically, this piece will focus on alternative mutual fund (AMF) performance through the 1st quarter of 2020. AMFs offer exposure to “hedge fund-like” strategies among other non-traditional approaches within a mutual fund structure. Thus, they can be a liquid and cost-effective means to enhance portfolio diversification.

For the scope of this piece we will define the Corona Market as the equity declines experienced from February 19th through March 23rd. As much uncertainty around the COVID-19 virus and its economic impacts remain, it is important to understand that volatility may persist and that a new low may be established before the drawdown is officially measured. Working with this definition of the Corona Market allows us to make some unique observations about the recent market drawdown.

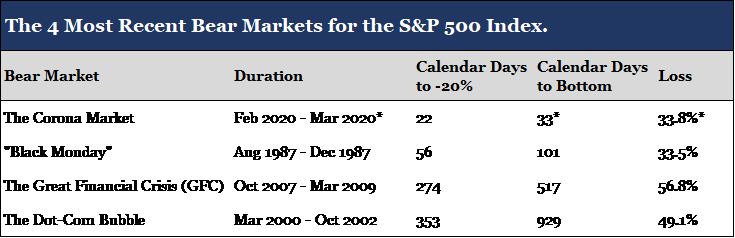

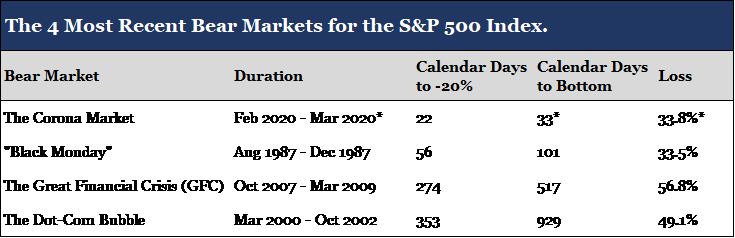

The Corona Market

The total loss to the S&P 500 Index, a barometer for US equity markets, amounted to 33.8%. According to data from the CFRA, the average loss experienced during all bear markets dating back to 1929 is 38.2%. Thus, from a historical perspective, the Corona Market was below average in magnitude. However, what made the drawdown so extreme was the speed in which it took place.

*Assumes that the March 23rd index low is the bottom of the Corona Market. Data for the table was sourced from CFRA and S&P Down Jones Indices.

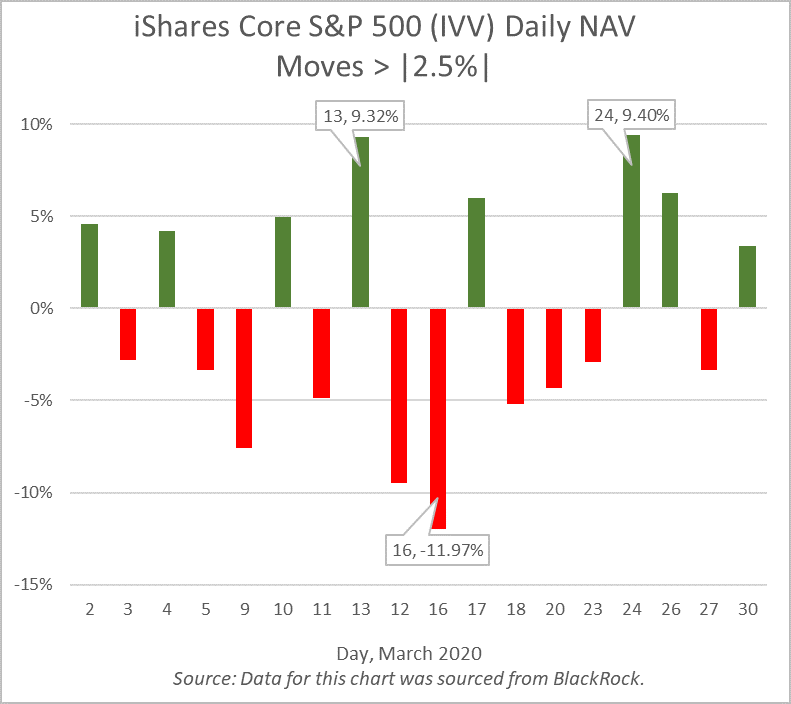

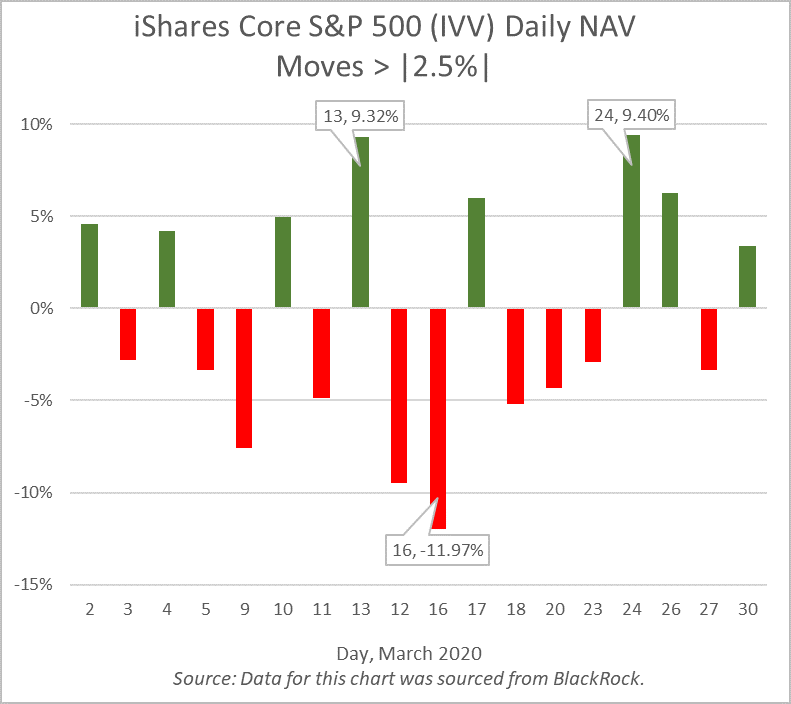

As demonstrated by the table above, the Corona Market decline reached 20% (the definition of a bear market) in 22 calendar days. This is less than half the time it took markets to reach bear territory in 1987 (“Black Monday”) and far below the average of 254 calendar days dating back to 1929. The Corona Market also reached its current low in just 33 days. Such extreme price volatility highlights the uniqueness of a pandemic induced selloff. Taking a closer look, the following chart represents daily NAV changes in excess of +/- 2.5% for the iShares Core S&P 500 ETF (IVV), a passive ETF that tracks the returns of the S&P 500 Index.

The ETF, ticker IVV, had daily NAV moves in excess of +/- 2.5% for 18 out of the 22 trading days in March. This included the March 16th decline of nearly 12%, the S&P’s third largest daily price decline in history (“Black Friday” is the largest daily price decline at -20.5%). As a result, the VIX Index, the market’s forward-looking indicator of volatility, closed at an all-time high of 82.69 the same day.

Alternative Mutual Funds, Passing the Test

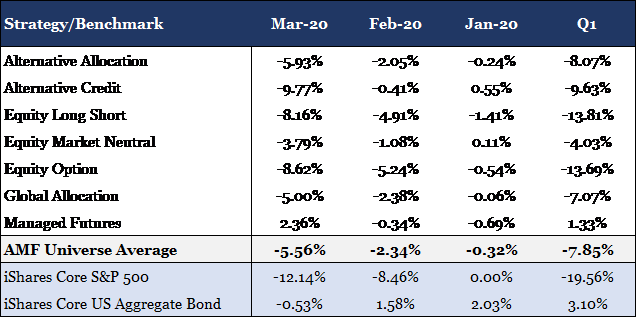

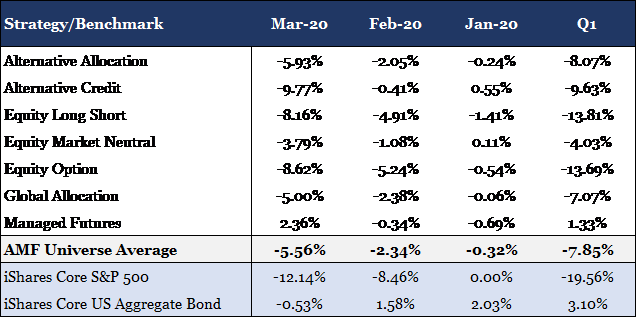

The speed and volatility witnessed during the market drawdown was historic. Working with this understanding of the Corona Market, we can now visit AMF performance for this period within the appropriate lens. The following table represents the performance of the AI Insight universe of AMFs. AI Insight focuses our coverage on funds that execute alternative strategies designed to be held as part (or as all) of an alternative allocation. We also aim to limit our coverage to funds with established track records and sustainable levels of total AUM. The universe is organized into 7 strategy groups, for which the table presents the average performance of each.

The data for the table was sourced from the AI Insight AMF database.

The strongest performer for the period was Managed Futures delivering positive 1.33% through the first quarter. It was the only strategy to remain in the black propelled by a positive 2.36% return during the month of March. Historically, Managed Futures have struggled to capture sharp price reversals as the strategy relies on sustained price trends to build portfolio positions. However, many managers today have increased their weighting toward short term trading strategies and trend signals to better capture downward price swings. This is often referred to as “crisis alpha”, the ability to capture persistent trends that occur across markets during turbulent periods.

Below the AMF universe average for the period were the equity and credit alternative strategies (e.g. Equity Long Short, Equity Option, and Alternative Credit). These funds will typically have higher exposures to risk assets, and as a result, a higher correlation to traditional markets. Furthermore, it is possible the orientation of this market crisis (virus induced shutdown) may have led managers to be more aggressive than they otherwise would have been in a low growth and/or fundamentally weak economy. Prior to the selloff, the financial health of companies and consumers was considerably stronger than what was seen in 2008.

One exception to the equity alternative strategies was Equity Market Neutral. More specifically, the Event Driven sub-strategy of Equity Market Neutral that focuses on mergers and acquisitions among other corporate related events. The sub-strategy was a stronger performer for the period delivering -2.83% performance through the first quarter. These funds are unique in that they invest almost exclusively in equity and equity related securities yet provide a low beta return profile. The -2.83% return equates to a 16.73% outperformance over the iShares Core S&P 500 ETF for the first quarter.

Conclusion

Overall, AMFs delivered strong relative results during the Corona Market with the universe average outperforming the S&P 500 by 11.71% during the first quarter. This included downside protection for both the month of February and March as the average outperformed the equity index by 6.12% and 6.58% respectively. Strategies performed as expected with the more correlated strategies under-performing the average AMF but still out-performing equities, and the less correlated strategies out-performing both the average AMF and the equity markets.

Consistent with these results was the Alternative Allocation strategy which delivered -8.07% for the first quarter as compared to the -7.85% return for the universe. These funds actively invest across multiple alternative strategies and managers within a single fund, providing broad exposure to alternative sources of return. Similarly, the strategy delivered downside protection in both February and March outperforming the equity index by 6.41% and 6.07% respectively.

As demonstrated during the first quarter of 2020, AMFs provide the potential for increased portfolio diversification and downside protection relative to traditional equities. This may serve to reduce portfolio risk during an equity selloff as witnessed during the Corona Market. As mentioned previously, the current low to equity markets occurred on March 23rd. However, there is still much uncertainty that remains around the COVID-19 virus such as potential treatments and vaccines, how best to re-open the economy, and how we will manage the increased debt load that the government and many companies are undertaking to weather the economic shutdown. Despite these uncertainties, equity markets have stabilized since the March 23rd lows appreciating approximately 27% on the backbone of positive hospitalization trends and historic fiscal and monetary policy measures (the S&P 500 is currently down 12.2% through Friday, April 24th). The road may be long, but as mentioned before, diversification is an effective tool in any risk management strategy.

Wednesday, April 8th, 2020 and is filed under Industry Reporting

We recently released our March Private Placement Insights. See the highlights from the report below, or if you are a Premium Reporting subscriber, log in now to see the entire report. If you don’t have access, you can request a free trial.

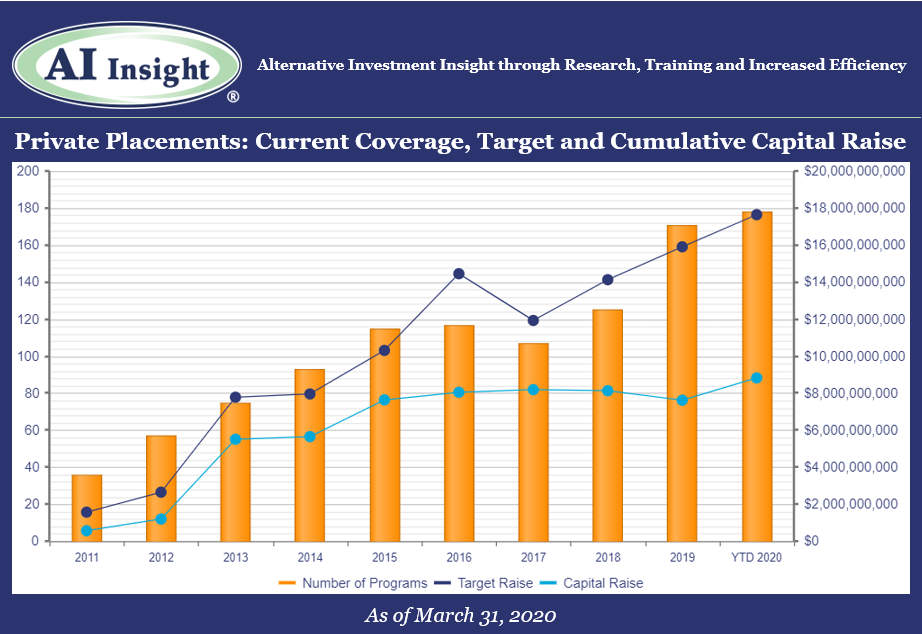

- 15 new private placements were added to our coverage in March, just below the last couple of months but still well over last year’s levels. The industry continues to be led by real estate focused categories including 1031s and real estate LPs and LLCs.

- As of April 1st, AI Insight covers 178 private placements currently raising capital, with an aggregate target raise of $17.6 billion and an aggregate reported raise of $8.8 billion or 50% of target. The average size of the current funds is $99.1 million, ranging from $3.5 million for a single asset real estate fund to $2.5 billion for a sector specific private equity/debt fund.

- 13 private placements closed in March, having raised approximately 70% of their target and having been on the market for an average of 311 days.

- ON DECK: as of April 1st, there were five new private placements coming soon.

Market Update: COVID-19 Impact on Private Placement Markets

On March 11, 2020, the World Health Organization (the WHO) declared the COVID-19 coronavirus a global pandemic. Trade and travel have since grind to a halt with travel restrictions and stay at home orders issued across the globe. The US and global economies are in recession territory, with GDP in the United States now forecast to decline by 0.2% instead of expanding by 2.0% in 2020 as a result of COVID-19. While the full impact of the global pandemic may take years to determine, the one thing we do know is that it will have a significant impact on all aspects of investing both in the public and private markets. Transactions are slowing across the private placement categories and valuations, which require transactions, may be less reliable or difficult to obtain.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, BDCs, Closed-End Funds, and Alternative Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of March 31, 2020, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright ©2020 AI Insight. All Rights Reserved.