Infinity Q Diversified Alpha Fund Suspends Redemptions and Plans to Liquidate Assets

Monday, March 22nd, 2021 and is filed under Alternative Strategy Mutual Funds

What Happened

On Monday, February 22, 2021, the Infinity Q Diversified Alpha Fund (Fund) and its investment adviser, Infinity Q Capital Management (Infinity Q), sought and obtained an order from the Securities and Exchange Commission (SEC) permitting the Fund to suspend redemptions indefinitely. The Fund is expected to liquidate assets and distribute the proceeds to shareholders with the assistance of a third-party valuation service and the oversight of the SEC’s Division of Investment Management[i]. At this time, there is no estimate of when the liquidation and distribution will be completed. Until then, redemptions of Fund shares will remain suspended[ii].

Why It Happened

The Fund invested according to an alternative investment strategy that primarily used complex derivative instruments to derive intended exposures. According to the Fund’s most recent financial statement, this included correlation swaps, dispersion swaps, and variance swaps, among various other contracts. Adding to the complexity, a significant portion of these assets were categorized as Level 3 for which market prices are not readily available[iii]. For such securities, third-party services are required in estimating the fair value for purposes of calculating the Fund’s net asset value (NAV).

Based on information learned by the SEC and shared with Infinity Q, it was determined the Fund’s portfolio manager had been adjusting certain parameters within the third-party pricing model being used to estimate the fair value of the Fund’s swap contracts[iv]. Upon review, Infinity Q released the Fund’s portfolio manager, who is also the firm’s CIO and Founder, and determined that it was unable to value the current positions nor confirm the historical values of the Fund’s swap contracts. Presumably to avoid a “run on the bank” situation, which can lead to depressed prices and further losses for investors, Infinity Q sought the order from the SEC while it enlists the services of an independent valuation firm to calculate an accurate NAV for the fund.

Key Takeaways for Alternative Mutual Fund Investors

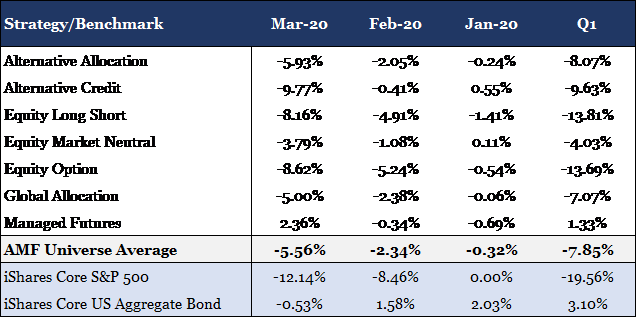

Despite the increased regulatory oversight of the mutual fund structure, relative to private funds and hedge funds, financial professionals and investors must exercise caution when using alternative mutual funds (AMFs). This is due to the increased complexity that may be present within the product structure including short positions, derivatives instruments, illiquid investments, and leverage. The complexity broadens the opportunity set of these funds allowing portfolio managers to pursue non-traditional investment strategies that may provide enhanced portfolio diversification, systematic risk reduction, and alternative sources of return. However, they may also increase risk and reduce transparency for investors, as demonstrated by the recent developments in the Infinity Q Diversified Alpha Fund. As such, consider the following:

- Is the strategy comprehendible? If upon reviewing the fund, you are unclear as to what the fund does and why, exercise extreme caution. An overly complicated strategy that cannot be explained is potentially a red flag. Furthermore, if the fund cannot be understood completely, nor can the inherent risks.

- Does the fund make heavy use of derivatives? This alone is not a red flag. Derivative instruments increase efficiencies in capital markets and provide increased opportunity for return[v]. However, they also increase the potential for investors bearing risk they do not fully understand. As such, if you are unable to determine why a fund is investing in the types of contracts they do, or what exposures they provide, exercise extreme caution.

- Alternatives require increased due diligence. The complexity of an AMF calls for increased due diligence[vi]. If research resources are constrained or limited, consider the use of third-party services for education and research surrounding alternative investments. Services may help drive efficiencies in research, improve understanding, and increase regulatory compliance.

iCapital Network[1]

AI Insight by iCapital Network currently offers an AMF platform designed to provide financial firms and advisors a comprehensive tool for research with a focus on education and application (versus an investment rating). The platform is a web-based, subscription service and consists of two main components specific to AMFs:

- Comprehensive fund-level research reports that focus on a qualitative understanding of team, strategy, and process.

- A training and education platform inclusive of an extensive AMF module and strategy specific modules.

The platform focuses on mutual funds with alternative investment strategies consistent with the hedge fund industry. Funds covered by the platform are portfolio oriented and will typically have a minimum 2-year track record and $200 million in AUM.

The platform currently covers the Fund on a limited basis. As part of our fund-level research, we have a tiered system that includes full and limited reviews. The former includes investment due diligence summarized within the report while the latter aggregates only the available public data. Considering the Fund’s developments, the platform is actively pursuing ways to improve our process including an increase in our screening parameters for limited reviews, enhancing the existing derivative contract reporting, and summarizing Level 3 assets within each report.

For more information on the platform, please contact AI Insight Customer Care at (877) 794-9448 ext. 710 or via email at customercare@aiinsight.com.

Infinity Q Diversified Alpha Fund

The Fund sought to generate positive absolute returns by combining risk management with diversified alpha strategies. Per the latest summary prospectus, the four primary strategies included Volatility, Equity Long Short, Relative Value, and Global Macro. The investable universe included global markets across equities, fixed income, commodities, credit, and foreign exchange.

________________________________

Endnotes

[1] Institutional Capital Network, Inc. and affiliates (herein “iCapital Network”)

[i] Securities and Exchange Commission. https://www.sec.gov/rules/ic/2021/ic-34198.pdf

[ii] Infinity Q Capital Management, LLC. http://www.infinityqfunds.com/

[iii] Financial Accounting Standard 157 (FAS 157). https://www.investopedia.com/terms/f/fasb_157.asp

[iv] Securities and Exchange Commission. https://www.sec.gov/rules/ic/2021/ic-34198.pdf

[v] The Economics of Derivatives. https://www.nber.org/digest/jan05/economics-derivatives

[vi] FINRA Investor Alert. https://www.finra.org/investors/alerts/alternative-funds-are-not-your-typical-mutual-funds

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security offered by Institutional Capital Network, Inc. or its affiliates (together “iCapital Network”). Past performance is not indicative of future results. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors. An investment in an alternative investment entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. The information contained herein is subject to change and is also incomplete. This industry information and its importance is an opinion only and should not be relied upon as the only important information available. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed, and iCapital Network assumes no liability for the information provided.

This material is confidential and the property of iCapital Network, and may not be shared with any party other than the intended recipient or his or her professional advisors. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital Network.

Products offered by iCapital Network are typically private placements that are sold only to qualified clients of iCapital Network through transactions that are exempt from registration under the Securities Act of 1933 pursuant to Rule 506(b) of Regulation D promulgated thereunder (“Private Placements”). An investment in any product issued pursuant to a Private Placement, such as the funds described, entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. Further, such investments are not subject to the same levels of regulatory scrutiny as publicly listed investments, and as a result, investors may have access to significantly less information than they can access with respect to publicly listed investments. Prospective investors should also note that investments in the products described involve long lock-ups and do not provide investors with liquidity.

Securities may be offered through iCapital Securities, LLC, a registered broker dealer, member of FINRA and SIPC and subsidiary of Institutional Capital Network, Inc. (d/b/a iCapital Network). These registrations and memberships in no way imply that the SEC, FINRA or SIPC have endorsed the entities, products or services discussed herein. iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2021 Institutional Capital Network, Inc. All Rights Reserved.