Friday, January 24th, 2020 and is filed under Alternative Strategy Mutual Funds

If your firm approves all fund company mutual funds, additional due diligence may be needed based on continued regulatory guidance on alternative strategy mutual funds.

_________________________________________________________________________________________

Some financial firms have raised questions about the need for conducting additional research on alternative mutual funds given their complex structure compared to traditional mutual funds. Both FINRA and the SEC have published supporting regulatory detail to help differentiate the need for additional due diligence on alternative mutual funds.

How are you demonstrating your understanding of the complexities of alternative strategy mutual funds?

According to PwC’s recent report, Alternative asset management 2020-Fast forward to centre stage, “In the light of the attention from regulators, asset management firms should enter this new line of business well-prepared from a compliance and organisational standpoint. This includes:

- training

- assessing customer suitability

- marketing and education

- building out compliance and surveillance, and

- robust liquidity risk management.”

Take the first step. Let AI Insight help your firm:

1) Identify potential risk exposure

2) Determine due diligence needs

3) Establish policies and procedures around Alternative Strategy Mutual Funds

Contact us for a complimentary Risk Exposure Analysis to see if your firm may need to conduct additional due diligence on alternative strategy mutual funds.

Related Regulatory References

Training Resources

Thursday, February 7th, 2019 and is filed under AI Insight News

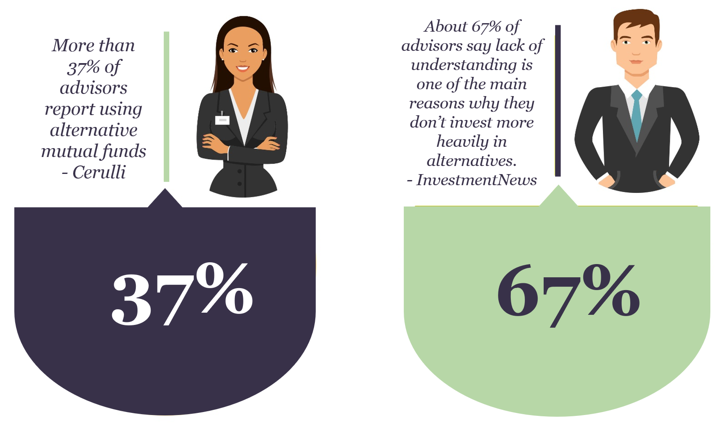

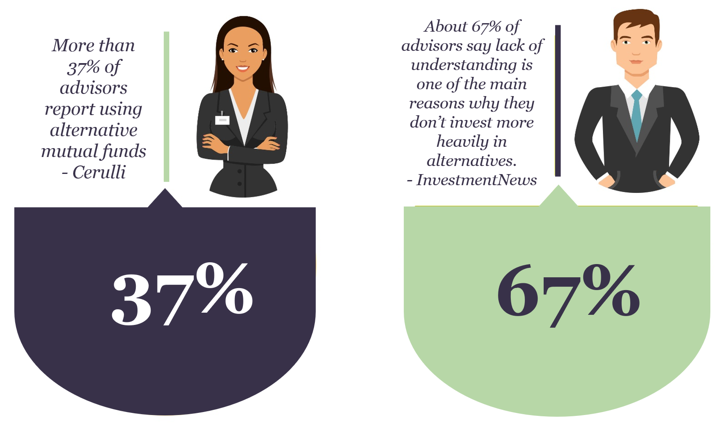

More advisors are working with alternatives as they become more accessible to average investors through the recent evolution of Alternative Mutual Funds. Cerulli’s recent report, “U.S. Alternative Investments 2018: Accessing Evolving Alternative Platforms“, focuses on trends in the U.S. alternative asset market. It concludes that more than 37% of advisors are working with alternative mutual funds.

However, other data tells us that advisors may not have the resources they need to research and apply alternative mutual funds in their practices. According to Investment News, about 67% of advisors say lack of understanding is one of the main reasons why they don’t use alternatives more frequently in their asset allocation models.

Get started now with 3 easy steps to help advisors understand the complexities of alternative mutual funds and help them remain regulatory-compliant.

- First, take 3 minutes to read this Q&A and gain a basic understanding of how Alternative Mutual Funds differ from traditional funds, learn how to address regulatory requirements and view our extensive list of resources.

- Next, take the CE course, “Introduction to Alternative Mutual Funds“ to understand key aspects, benefits and risks of these complex products.

- Finally, request a demo customized to your business needs to take a closer look at how an alternative-centered focus on research on various strategies including managed futures, long-short, market neutral and alternative allocation can help create efficiencies in your business.

Friday, February 1st, 2019 and is filed under AI Insight News

FINRA recently issued its 2019 Risk Monitoring and Examination Priorities Letter along with its 2018 Examinations Finding Report. These reports highlight, among other things, the continued focus on client suitability and overconcentration in non-traded investments, and the need for reasonable due diligence for private placements that is well documented.

Specifically, the 2019 Priorities Letter states,

“As always, suitability will remain one of FINRA’s top priorities. This year, some of the specific areas on which we may focus include: (1) deficient quantitative suitability determinations or related supervisory controls; (2) overconcentration in illiquid securities, such as variable annuities, non-traded alternative investments and securities sold through private placements; and (3) recommendations to purchase share classes that are not in line with the customer’s investment time horizon or hold for a period that is inconsistent with the security’s performance characteristics…”

The 2018 Findings Report stated,

“FINRA has observed instances where some firms that have suitability obligations under FINRA Rule 2111 (Suitability) failed to conduct reasonable diligence on private placements and failed to meet their supervisory requirements under FINRA Rule 3110 (Supervision). FINRA Regulatory Notice 10-22 describes the circumstances under which firms have an obligation to conduct a “reasonable investigation” by evaluating “the issuer and its management; the business prospects of the issuer; the assets held by or to be acquired by the issuer; the claims being made; and the intended use of proceeds of the offering.”

Additionally, in the 2018 Findings Report, FINRA outlines the characteristics of firms that have performed reasonable due diligence, and reminds firms conducting due diligence of their obligation to document both the “process and results” of such reasonable due diligence analysis.

Key Takeaways

- Carefully review and understand the specific suitability requirements for each non-traded or private placement program utilized, and ensure that your firm has a documented process in place to monitor the compliance with suitability requirements.

- Perform a “reasonable investigation” of all complex products, focusing on the specific factors outlined by FINRA in the 2018 Findings Report. For further guidance on what constitutes a “reasonable investigation,” review FINRA Regulatory Notice 10-22.

- Document the due diligence process – remember, if it isn’t documented, it was never done.

- If utilizing third party due diligence vendors, ensure that your firm independently investigates any red flags identified, and document your firm’s investigation and findings.

Let AI Insight help you stay Compliant

- Unbiased education: Access product-specific training on the features, risks and suitability for hundreds of offerings.

- Conduct research: Create efficiencies in your due diligence review process using our robust database to source new products as well as analyze and compare hundreds of alternative investment programs, including non-traded programs, private placements, and alternative mutual funds.

- Compliance documentation: Demonstrate what you’re doing to support your firm’s regulatory requirements in a transparent way. AI Insight captures all of the activity your firm members complete within the platform including training modules, offering document reviews and research conducted.

Resources

Tuesday, December 19th, 2017 and is filed under AI Insight News

As 2017 comes to a close, AI Insight CEO Sherri Cooke reflects on the past year and looks forward to what’s coming up in 2018.

Q: What are some of the key reflections you have about 2017 and some points of interest for the coming year?

SC: This year we increased the number of RIAs using the AI Insight platform, so I’m glad that we’re able to support RIAs as this channel continues to grow. We look forward to continuing to expand these relationships in 2018. We also made significant upgrades to our AI Insight Education Module functionality, and we’ve received a lot of positive feedback on the updates. We’re always working to make the platform easy to use and add more valuable capabilities.

One of the most exciting highlights as we close out 2017 is the fact that we will be launching a new feature with expanded alternative mutual fund research capabilities in the new year. Advisors will be able to compare the details and financial performance of alternative investment mutual funds with reporting and documentation features our subscribers have come to rely on for more traditional Alternative Investment research. We’ve just hired Lucas Johnson who was a due diligence analyst with National Planning Holdings, Inc., where he specialized in due diligence reviews of liquid alternatives and other alternative investments. He’ll be stepping in to help launch our liquid alternative research program. You’ll see much more about this in the first quarter.

From an industry perspective, there’s been a bit of a relief relative to the DOL Fiduciary Rule implementation date, yet it doesn’t change the focus on compliance and regulatory scrutiny. The continued market run is remarkable, to say the least, inspiring growth and confidence. But that kind of house-of-straws confidence can increase concern about the negative consequences of a potential market correction. Smooth or bumpy, it’s our commitment to help advisors and clients manage the environment no matter what 2018 may bring.

Q: What are some of the major misconceptions you see that advisors have about alternative investments?

SC: A couple of misconceptions come to mind. The first would be that illiquidity or alternatives are intrinsically inferior planning tools. Another would be the challenges around compliance and regulatory scrutiny.

Q: Ok – let’s address the liquidity issue first.

SC:

I don’t believe that liquidity is the true issue. If a client’s portfolio is well diversified including appropriately positioned liquid and illiquid investments, then the illiquidity can actually be a true positive. It can prevent clients from selling investments when their motivation is emotionally-driven or reactive to the market.

Second, some people use the generalized claim that alternatives haven’t performed well over the last several years. As with all securities, some do well and some do not – and as with other investments there have certainly been a share of alternatives that haven’t performed as expected. However, there are a lot that have performed well when diligence has been taken in selecting and vetting – and they have been sold correctly. If a key goal is for alts to be used as a portfolio stabilizer, then we wouldn’t have seen them stand out during the crazy bull markets we’ve experienced. That’s not one of their key purposes. Many advisors want a significant premium for the illiquidity, but I don’t believe you should expect to get both the downside market protection in a bear market and returns that exceed the average in bull markets from the same vehicle.

It’s a challenge for me when I hear the expectation of alts always having to perform. Stocks lose value all the time. It really comes down to making sure these products are properly sold and positioned within client portfolios; and – as with all investments – conducting the best possible research and diligence to select best in class.

Q: You mentioned compliance – we know that compliance is often an issue for advisors in considering alternative investments and regulatory scrutiny continues to increase. What is your experience with compliance issues?

SC: Compliance is one of the things that motivated me to create AI Insight in the first place. I wanted to build capabilities to facilitate due diligence and proper compliance along with education and documentation of these efforts when selling complex products – those products that the regulators have called out as needing heightened supervision or training.

From a company perspective, we have found in any situation of which we’re aware, if you stay up-to-date on the requirements around selling any type of investment – and make sure everyone involved is aware of their obligations, adhering to the process, plus documenting all efforts – then the regulators are generally satisfied. That’s been our experience with our clients and their audits.

If you fail to make these efforts up front and you’re inconsistent in how you conduct your business from a compliance perspective, you’re just leaving yourself open to trouble from a client who ends up unhappy about something or getting in the news for the all the wrong reasons.

Q: You are involved in mentoring young women in the financial industry. Tell us about it.

SC: A group of members of the Investment Program Association (IPA) formed the Women’s Initiative Network (WIN). One of our key goals has been to help promote and support women within the financial services industry, which traditionally has been very male-dominated. I launched our first local initiative with Ohio State University’s Fisher School of Business this past year. We had a group of young women who had an interest in Financial Services get together once a month to hear stories about the journeys of women in our area who have been successful in the financial world.

We talked through some of their concerns and real-life challenges they’ve encountered or that we, as mentors, have experienced. We also introduced them to many unknown and non-mainstream facets of the investment world, which was really exciting.

Q: What is your focus for 2018?

SC: From a business owner’s perspective, ensuring that our team and our product continues to maintain consistent integrity of value and exceptional service; this is the backbone of our business – and making sure that our AI Insight team is challenged and fulfilled in their roles within our company.

From an industry perspective – we believe that there is a tremendous amount of value for advisors to differentiate themselves and bring really great opportunities through the thoughtful and diligent understanding of alternative products. We provide this value by building and bringing together our network of broker-dealers, advisors, RIAs, alternative investment firms and industry partners.

Therefore, as in past years, I always look forward to working with our business partners to explore new possibilities and find what more we can bring to the table for our customers in the new year.

As I’ve already mentioned, I’m excited about developing even more education and support in the liquid alternatives space. These funds are gaining increased awareness from a due diligence and compliance perspective. We currently have education and training for 30 closed-end funds available on our platform and expect to see real growth in this area in the coming year. We’ve expanded our CE course offerings to include a FINRA alternative mutual fund course and a course on interval funds. Plus, we’ve recently published a comprehensive white paper called, “Understanding the Complexities of Liquid Alternatives” to help support these growth plans in 2018. I’m really proud of our efforts when it comes to education on key industry initiatives and concerns, so we are particularly excited about the new plans around the liquid alts sector for the coming year. It’s important to our entire team that we continue to do our very best to evolve with the industry – hopefully always a few steps ahead of the primary curve – to bring our customers what they need to confidently offer their clients a full and rich palette of investment solutions. That’s our goal for 2018…and every year after!

Sherri Cooke is the CEO and founder of AI Insight, Inc. and has been in the financial services industry for over 25 years. Cooke formed AI Insight in 2005 with the primary goal of providing the financial planning community with a consistent database of alternative investment programs.

Tuesday, May 13th, 2014 and is filed under AI Insight News

Considering the sheer size of the financial industry in the United States, you may think the odds of a regulatory review are fairly slim. However, FINRA Chairman and CEO Richard Ketchum recently stated that while FINRA regulates about 4,100 brokerage firms and about 635,000 registered securities representatives, “we are out there on the ground and in the field every single day—in offices all across the country—overseeing virtually every aspect of the securities business.” Read More

Considering the sheer size of the financial industry in the United States, you may think the odds of a regulatory review are fairly slim. However, FINRA Chairman and CEO Richard Ketchum recently stated that while FINRA regulates about 4,100 brokerage firms and about 635,000 registered securities representatives, “we are out there on the ground and in the field every single day—in offices all across the country—overseeing virtually every aspect of the securities business.” Read More

Saturday, December 15th, 2012 and is filed under AI Insight News

December 15, 2012 – FINRA Regulatory Notice 12-55: Guidance on FINRA’s Suitability Rule. In November 2010, the Securities and Exchange Commission approved FINRA Rule 2111 (Suitability), which became effective on July 9, 2012. In May 2012, FINRA issued Regulatory Notice 12-25, which provides guidance on the rule in a frequently asked questions format. This Noticeaddresses two issues discussed in Regulatory Notice 12-25: the scope of the terms “customer” and “investment strategy.” In addition, FINRA has created a suitability web page that, among other things, will locate in one place questions and answers regarding FINRA Rule 2111. The suitability website can be found here and Notice 12-55 can be read in its entirety here.

Read More

Considering the sheer size of the financial industry in the United States, you may think the odds of a regulatory review are fairly slim. However, FINRA Chairman and CEO Richard Ketchum recently stated that while

Considering the sheer size of the financial industry in the United States, you may think the odds of a regulatory review are fairly slim. However, FINRA Chairman and CEO Richard Ketchum recently stated that while