Tuesday, December 22nd, 2020 and is filed under AI Insight News

AI Insight CEO Sherri Cooke discusses her key reflections for 2020 including how alternative investments played an important role in portfolios and the impacts of Reg BI. She also shares what’s anticipated in 2021. Read the narrative below or listen to the podcast here.

Sherri formed AI Insight in 2005 with the primary goal of providing the financial planning community with a more efficient and consistent way to access factual information on alternative investment programs – and from that vision the AI Insight database was born.

Q: What are some of the key reflections you have about 2020 and some points of interest for the coming year?

SC: I would say as a ADISA Board member, I was fortunate to be able to spend quite a bit of time this year collaborating with others in the alternative investment industry focusing on some of the things we can do to make the industry better – and to increase the awareness and understanding of these products within a growing audience. I believe we all have to work together to bring this space to a whole new level. Also, as Reg BI requirements continue, we’re looking at ways to partner with compliance and technology workflow companies that are helping to support these needed processes. We’re also looking to connect with other companies – both inside and outside the traditional alternatives space to further increase consistency and transparency in the industry with an ultimate goal of making it easier to conduct alts business.

Q: How do you think alternative investments played an important role in portfolios this past year, especially given the pandemic?

SC: We’re always looking for ways to give more to people – who are of course qualified – access to alternative investments to help them really diversify their portfolio in a meaningful way. Our belief is that a person isn’t fully diversified if all of their underlying investments are either in some way tied to the markets or are invested in a fixed income security – which is effectively still tied to the market.

Despite the pandemic – and in some cases as a result of – there are a lot of really solid opportunities to invest in real assets, interesting investment structures, and institutionally supported opportunities through alternative investments that really provide true diversification.

That said, alternatives can certainly be complex and they need to be factually understood and appropriately sold. This industry really needs to educate financial professionals and investors in so many different ways. One of those has to be around creating realistic expectations about what these investments are intended to bring to a diversified investment portfolio…and what they are not. Stocks lose value all the time and there will be alts that don’t perform. As an industry, we really need to do our very best to ensure that these products are properly sold and positioned within client portfolios. And – as with all investments – we support conducting the best possible research and diligence to allow firms and advisors to select best of class – and help the vested financial firms and producers drive product sponsors toward best of class practices.

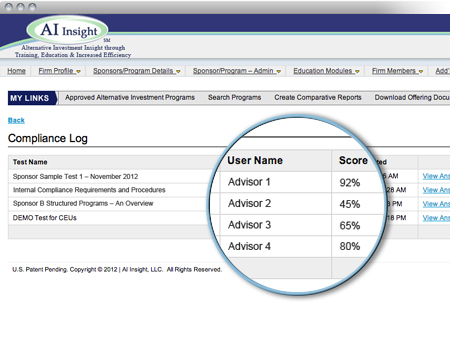

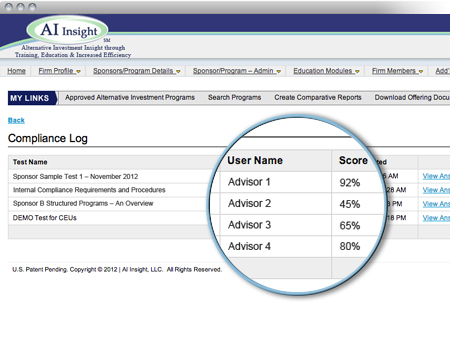

Q: We know that compliance is often an issue for advisors in considering alternative investments – and regulatory scrutiny continues to increase. The SEC’s Regulation Best Interest implementation took place on June 30. How does AI Insight help streamline Reg BI requirements?

SC: Compliance is one of the things that motivated me to create AI Insight in the first place. I wanted to build capabilities to facilitate due diligence and proper compliance along with education and documentation of these efforts when selling complex products – those products that the regulators have called out as needing heightened supervision or training.

From an audit perspective, we’ve found in any situation of which we’re aware with our clients, if a firm has stayed up-to-date on the requirements around selling different types of investments – and makes sure everyone involved is aware of their obligations, adheres to the processes, and documents their efforts – then the regulators are generally satisfied. If you fail to make these efforts up front and you’re inconsistent in how you conduct your business from a compliance perspective….you’re just leaving yourself open to trouble.

Reg BI – within the BD community – and I think even though the fiduciary standard has always applied RIA space – we’re going see a whole new layer of extra scrutiny in this regard. The processes that have been central to our platform for years can help support Reg BI requirements and help financial firms and professionals demonstrate the “good faith and reasonable efforts” that Reg BI requires on an ongoing basis. Specifically, we’ve created a comprehensive Reg BI Guide that steps through the Compliance and Care Obligations and correlates the AI Insight support resource to that particular SEC requirement. Again, this is just another way that we help to create efficient and consistent educational and compliance workflows that can help firms at both the product and the firm level.

Q: What is your focus for 2021?

SC: From a business owner’s perspective, ensuring that our team and our product continues to maintain consistent integrity of value and exceptional service; this is the backbone of our business – and making sure that our AI Insight team is challenged and fulfilled in their roles within our company.

From an industry perspective – we believe that there is a tremendous amount of value for advisors to differentiate themselves and bring really great opportunities through the thoughtful and diligent understanding of alternative products. We provide this value by building and bringing together our network of broker-dealers, advisors, RIAs, alternative investment firms and industry partners. Therefore, as in past years, I am always grateful for how far we’ve been able to come and to everyone who has helped us be successful in our efforts to support this industry – and I look forward to working with all of our business partners to explore new possibilities and find what more we can bring to the table for our customers in the new year.

Friday, March 27th, 2020 and is filed under AI Insight News

|

Your daily routine may be in disarray, but it’s business as usual at AI Insight since we have been successfully operating as virtual company for many years. As always, we’re here to help you with your AI Insight needs and anything else that might help you when working remotely.

To be successful working remotely, you need a strategy, focus and a little fun. We’ve compiled some resources that we’ve used in practice to help you accomplish this. |

Get Started

It’s important to designate a specific area that you use solely as your workspace to establish your “work zone” not only for your benefit, but for family members who are at home with you. Traveling around your house with your laptop or working where you sleep invites interruption.

Stay Focused

It’s easy to become distracted by the TV, social media or the pile of dishes in the sink. Creating a schedule for yourself – including breaks and lunchtime as you would at the office – can help you concentrate on your work. Setting a specific work schedule will also help you set expectations for other family members who are at home and help you keep a healthy work-life balance.

Industry Resources

You may be used to attending industry conferences or face-to-face group meetings, which have been postponed or cancelled. AI Insight created a central resource to help you stay connected with industry groups such as ADISA, IPA, FINRA and more. Check back frequently as we will continue to post industry webinar events happening in lieu of conferences.

Technology Resources

Having the right equipment is essential to working from home. But, knowing how to make the most of technology tools can be challenging.

- Zoom is a remote video conferencing and web conferencing service.

- Microsoft Teams is a unified communication and collaboration platform that combines workplace chat, video meetings, file storage, and application integration.

Stay Connected

We all know that miscommunication can happen over email and text. Convey your tone with a phone call instead of email when you can. Even better, turn on your video during online meetings to express your body language. Remember to test out your video feature before you use it publicly, so you can check your background surroundings and test your microphone.

This is also a good opportunity to get to know your co-workers on a personal level. At AI Insight, we’ve created a social channel within our Microsoft Teams platform to talk about topics unrelated to work and share photos on occasions like Halloween and St. Patrick’s Day. This helps us get to know each other better and stay connected.

Be Mindful

We’ve created a “Get Up & Move” rewards program at AI Insight to encourage everyone to walk away from their computer once an hour. We also host quarterly Lunch & Learns to help our team stay healthy in mind and body such as chair yoga sessions and meditation practices. Taking breaks can boost productivity and rejuvenate you when motivation drops.

Contact Us

From everyone at AI Insight, we want you to be safe and healthy. Again, we’ve been incorporating these practices for many years. If there’s something we can help you with on any of these topics, please reach out to us Monday through Friday from 8:00 a.m. to 6:00 p.m. at 877-794-9448 ext. 710 or any time at customercare@aiinsight.com.

Monday, January 13th, 2020 and is filed under AI Insight News

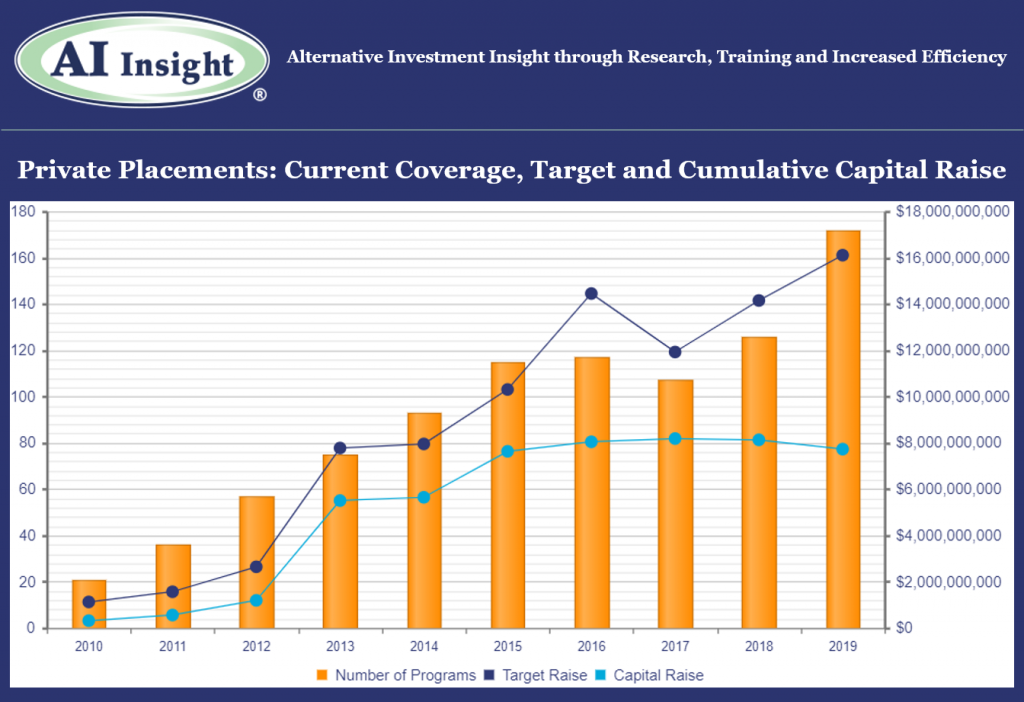

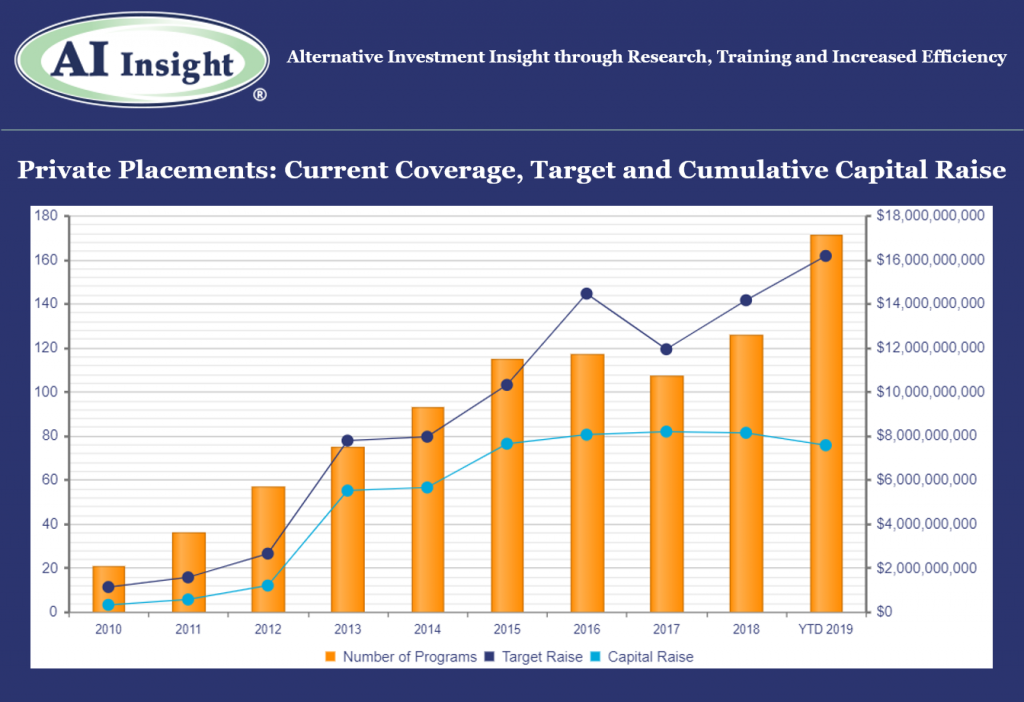

We recently released our December Private Placement Insights. See the highlights from the report below, or if you are a subscriber, log in now to see the entire report.

- More private placements were added to our coverage in 2019 than ever before with record months in November and December. The 200 private placement funds added during the year were slightly smaller in overall target raise than 2018, with the aggregate just 1.3% above last year despite the increased number of funds.

- The industry was led primarily by continued growth in 1031 exchanges and the addition of Opportunity Zone funds. Private equity/debt activity picked up late in the year, as did conservation contributions and energy funds. Other real estate, which includes non-1031 real estate LLCs and LPs trailed, with fund sizes significantly smaller than in prior years.

- As of January 1st, AI Insight covers 172 private placements currently raising capital, with an aggregate target raise of $16.1 billion and an aggregate reported raise of $7.7 billion or 48% of target. The average size of the current funds is $93.2 million, ranging from $3.4 million for a single asset fund to $2.2 billion for a sector specific private equity/debt fund.

- 158 private placements closed in 2019, having raised approximately 85% of their target.

- ON DECK: as of January 1st, there were eight new private placements coming soon.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, BDCs, Closed-End Funds, and Alternative Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of Dec. 31, 2019, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright ©2020 AI Insight. All Rights Reserved.

Friday, November 8th, 2019 and is filed under AI Insight News

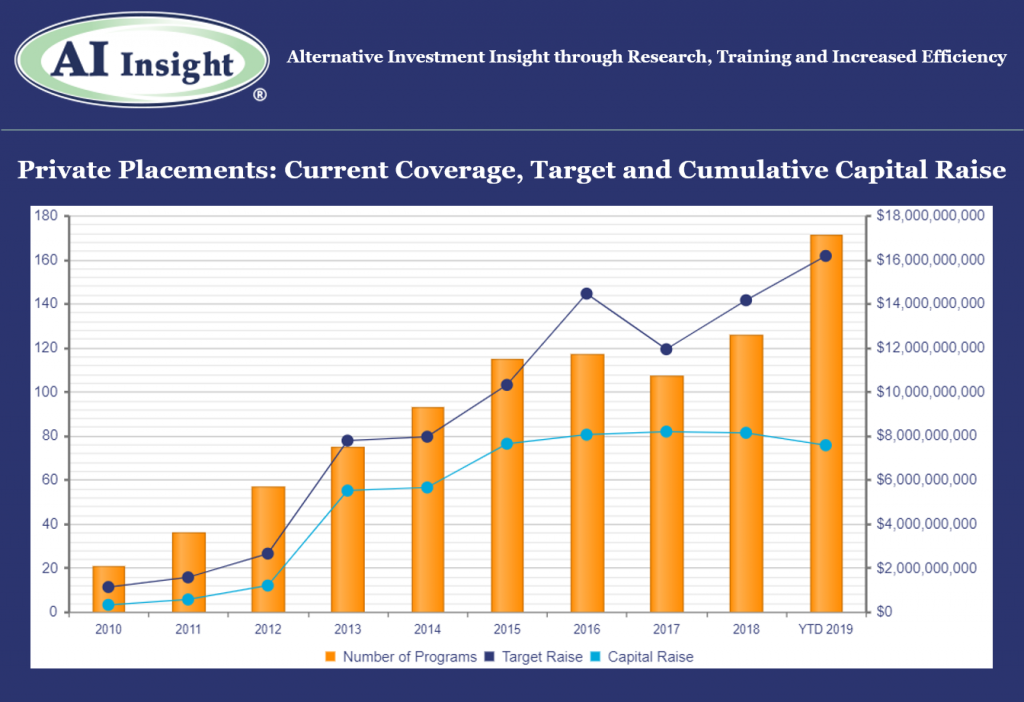

We recently released our October Private Placement Insights. Highlights from the report include:

- October private placement activity picked up after a slow September, primarily in the 1031 category.

- Our overall private placement coverage is up year-over-year in terms of new fund coverage and aggregate target raise, led primarily by 1031s and Opportunity Zones, while most other categories remain below last year’s levels.

- Our coverage of hedge funds and managed futures has not expanded in 2019. We discussed this in our September Private Placements podcast. We believe the minimal activity in the hedging and futures space can be attributable to a few factors. One is that funds and fund-of-funds used by many retail firms tend to be larger with a perpetual life that have been around for many years and used as needed. Allocations to hedging and futures strategies also tend to be smaller in the retail channel than the institutional side, so fewer options are available and many use liquid alternatives for these allocations, where we have seen a lot of growth and increased coverage in recent years. Additionally, the strong equity market over the last decade has minimized the focus on hedging and futures strategies.

- As of November 1st, AI Insight covers 171 private placements currently raising capital, with an aggregate target raise of $16.2 billion and an aggregate reported raise of $7.6 billion or 46.9% of target. This includes the 147 private placements added to our coverage in 2019.

- As of November 1st, 111 private placements have closed year-to-date which raised approximately 86% of their target raise. While there are still two months remaining, funds this year have come closer to their targets than last year, when the 160 private placements that closed in FY 2018 raised approximately 63% of their target.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, BDCs, Closed-End Funds, and Alternative Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of Oct. 31, 2019, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright © 2019 AI Insight. All Rights Reserved.

Friday, June 7th, 2019 and is filed under AI Insight News

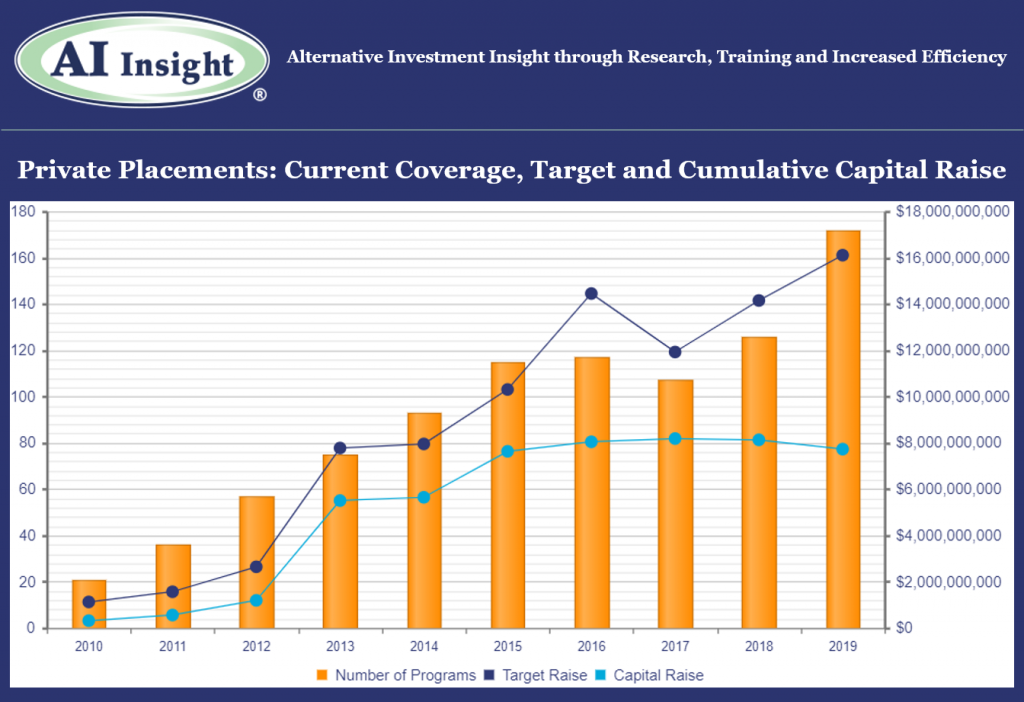

AI Insight recently added Industry Reporting capabilities to help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, BDCs, and Closed-End Funds, and Alternative Mutual Funds. You can receive up to 24 extensive reports per year to help broaden your alternative investment reviews. Read an overview of AI Insight’s expansive coverage as of May 31, 2019:

- AI Insight currently covers 145 private funds that are raising capital, representing just over $5 billion in capital raise/AUM. This includes 20 new funds added to our coverage in May, which was a significant month in terms of new fund formation.

- Five new opportunity zone funds have been added to our coverage YTD, including two in May, for an aggregate target raise of $640.0 million. Target raise ranges from $30 million to $275 million.

- Geographic focus ranges from specifically Maryland to the broader United States. Two funds are blind pool funds focused on hospitality, one is a blind pool fund focused on multifamily, and two are focused on specific mixed-use development projects.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. Plus, you can view more stats on other private placement categories and access Excel charts of this data.

Watch this tour or request a live demo of AI Insight’s expansive Industry Reports customized to your business needs.

_________________________________

Data as of May 31, 2019, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright © 2019 AI Insight. All Rights Reserved.

Tuesday, December 19th, 2017 and is filed under AI Insight News

As 2017 comes to a close, AI Insight CEO Sherri Cooke reflects on the past year and looks forward to what’s coming up in 2018.

Q: What are some of the key reflections you have about 2017 and some points of interest for the coming year?

SC: This year we increased the number of RIAs using the AI Insight platform, so I’m glad that we’re able to support RIAs as this channel continues to grow. We look forward to continuing to expand these relationships in 2018. We also made significant upgrades to our AI Insight Education Module functionality, and we’ve received a lot of positive feedback on the updates. We’re always working to make the platform easy to use and add more valuable capabilities.

One of the most exciting highlights as we close out 2017 is the fact that we will be launching a new feature with expanded alternative mutual fund research capabilities in the new year. Advisors will be able to compare the details and financial performance of alternative investment mutual funds with reporting and documentation features our subscribers have come to rely on for more traditional Alternative Investment research. We’ve just hired Lucas Johnson who was a due diligence analyst with National Planning Holdings, Inc., where he specialized in due diligence reviews of liquid alternatives and other alternative investments. He’ll be stepping in to help launch our liquid alternative research program. You’ll see much more about this in the first quarter.

From an industry perspective, there’s been a bit of a relief relative to the DOL Fiduciary Rule implementation date, yet it doesn’t change the focus on compliance and regulatory scrutiny. The continued market run is remarkable, to say the least, inspiring growth and confidence. But that kind of house-of-straws confidence can increase concern about the negative consequences of a potential market correction. Smooth or bumpy, it’s our commitment to help advisors and clients manage the environment no matter what 2018 may bring.

Q: What are some of the major misconceptions you see that advisors have about alternative investments?

SC: A couple of misconceptions come to mind. The first would be that illiquidity or alternatives are intrinsically inferior planning tools. Another would be the challenges around compliance and regulatory scrutiny.

Q: Ok – let’s address the liquidity issue first.

SC:

I don’t believe that liquidity is the true issue. If a client’s portfolio is well diversified including appropriately positioned liquid and illiquid investments, then the illiquidity can actually be a true positive. It can prevent clients from selling investments when their motivation is emotionally-driven or reactive to the market.

Second, some people use the generalized claim that alternatives haven’t performed well over the last several years. As with all securities, some do well and some do not – and as with other investments there have certainly been a share of alternatives that haven’t performed as expected. However, there are a lot that have performed well when diligence has been taken in selecting and vetting – and they have been sold correctly. If a key goal is for alts to be used as a portfolio stabilizer, then we wouldn’t have seen them stand out during the crazy bull markets we’ve experienced. That’s not one of their key purposes. Many advisors want a significant premium for the illiquidity, but I don’t believe you should expect to get both the downside market protection in a bear market and returns that exceed the average in bull markets from the same vehicle.

It’s a challenge for me when I hear the expectation of alts always having to perform. Stocks lose value all the time. It really comes down to making sure these products are properly sold and positioned within client portfolios; and – as with all investments – conducting the best possible research and diligence to select best in class.

Q: You mentioned compliance – we know that compliance is often an issue for advisors in considering alternative investments and regulatory scrutiny continues to increase. What is your experience with compliance issues?

SC: Compliance is one of the things that motivated me to create AI Insight in the first place. I wanted to build capabilities to facilitate due diligence and proper compliance along with education and documentation of these efforts when selling complex products – those products that the regulators have called out as needing heightened supervision or training.

From a company perspective, we have found in any situation of which we’re aware, if you stay up-to-date on the requirements around selling any type of investment – and make sure everyone involved is aware of their obligations, adhering to the process, plus documenting all efforts – then the regulators are generally satisfied. That’s been our experience with our clients and their audits.

If you fail to make these efforts up front and you’re inconsistent in how you conduct your business from a compliance perspective, you’re just leaving yourself open to trouble from a client who ends up unhappy about something or getting in the news for the all the wrong reasons.

Q: You are involved in mentoring young women in the financial industry. Tell us about it.

SC: A group of members of the Investment Program Association (IPA) formed the Women’s Initiative Network (WIN). One of our key goals has been to help promote and support women within the financial services industry, which traditionally has been very male-dominated. I launched our first local initiative with Ohio State University’s Fisher School of Business this past year. We had a group of young women who had an interest in Financial Services get together once a month to hear stories about the journeys of women in our area who have been successful in the financial world.

We talked through some of their concerns and real-life challenges they’ve encountered or that we, as mentors, have experienced. We also introduced them to many unknown and non-mainstream facets of the investment world, which was really exciting.

Q: What is your focus for 2018?

SC: From a business owner’s perspective, ensuring that our team and our product continues to maintain consistent integrity of value and exceptional service; this is the backbone of our business – and making sure that our AI Insight team is challenged and fulfilled in their roles within our company.

From an industry perspective – we believe that there is a tremendous amount of value for advisors to differentiate themselves and bring really great opportunities through the thoughtful and diligent understanding of alternative products. We provide this value by building and bringing together our network of broker-dealers, advisors, RIAs, alternative investment firms and industry partners.

Therefore, as in past years, I always look forward to working with our business partners to explore new possibilities and find what more we can bring to the table for our customers in the new year.

As I’ve already mentioned, I’m excited about developing even more education and support in the liquid alternatives space. These funds are gaining increased awareness from a due diligence and compliance perspective. We currently have education and training for 30 closed-end funds available on our platform and expect to see real growth in this area in the coming year. We’ve expanded our CE course offerings to include a FINRA alternative mutual fund course and a course on interval funds. Plus, we’ve recently published a comprehensive white paper called, “Understanding the Complexities of Liquid Alternatives” to help support these growth plans in 2018. I’m really proud of our efforts when it comes to education on key industry initiatives and concerns, so we are particularly excited about the new plans around the liquid alts sector for the coming year. It’s important to our entire team that we continue to do our very best to evolve with the industry – hopefully always a few steps ahead of the primary curve – to bring our customers what they need to confidently offer their clients a full and rich palette of investment solutions. That’s our goal for 2018…and every year after!

Sherri Cooke is the CEO and founder of AI Insight, Inc. and has been in the financial services industry for over 25 years. Cooke formed AI Insight in 2005 with the primary goal of providing the financial planning community with a consistent database of alternative investment programs.

Wednesday, May 28th, 2014 and is filed under AI Insight News

Broker Dealers are finding the Regulatory focus and the need to provide documentation increasingly demanding – particularly when it comes to offering complex products to their clients. As new regulations are released, a trend toward a fiduciary standard for broker dealers and their advisors appears to be emerging. Read More

Broker Dealers are finding the Regulatory focus and the need to provide documentation increasingly demanding – particularly when it comes to offering complex products to their clients. As new regulations are released, a trend toward a fiduciary standard for broker dealers and their advisors appears to be emerging. Read More

Thursday, February 13th, 2014 and is filed under AI Insight News, Press Releases

The Investment Program Association (IPA), a trade association for non-listed direct investment vehicles, and AI Insight, the financial industry’s most trusted source for alternative investment product information and training, today announced that a new and uniquely powerful direct investments compliance tool, the AI Insight Daily Blue Sky Report, will be available to IPA members. Read More

Monday, June 24th, 2013 and is filed under AI Insight News, Press Releases

AI Insight, the financial industry’s most trusted source for alternative investment product information and training, has expanded its online platform to include enhanced financial performance monitoring and reporting for public programs. Read More

Tuesday, June 11th, 2013 and is filed under AI Insight News

FINRA recently issued Regulatory Notice 13-18: Communications With the Public to provide guidance to firms on communications with the public concerning unlisted real estate investment programs, including unlisted real estate investment trusts (REITs) and unlisted direct participation programs (DPPs) that invest in real estate. This notice can be read in its entirety here. Read More