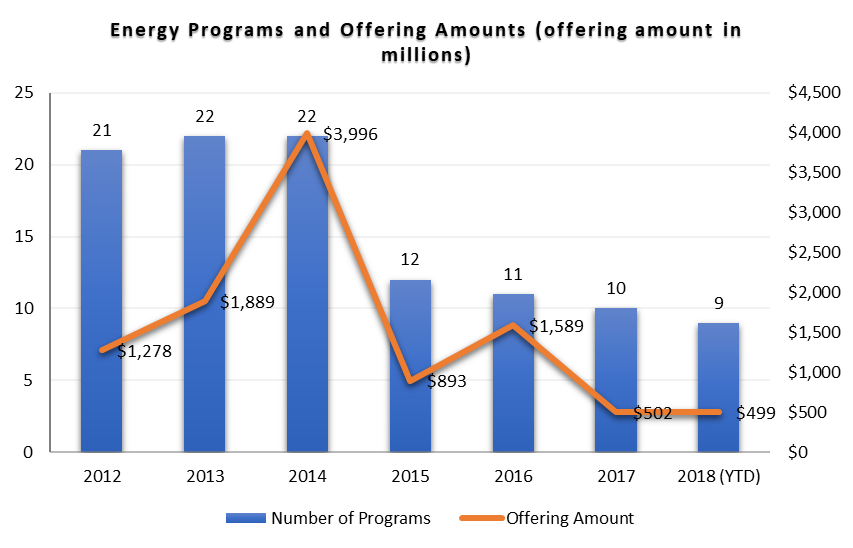

Private Placement Industry Highlights – June and YTD 2018

Monday, July 9th, 2018 and is filed under AI Insight News

A review of private placements on the AI Insight Platform.

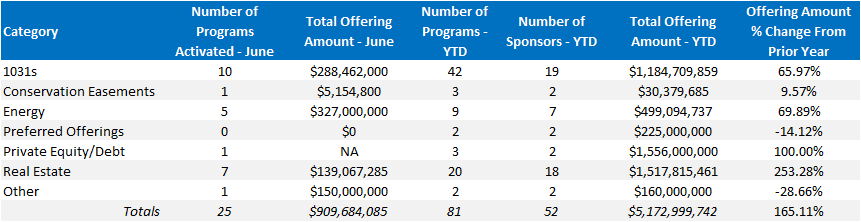

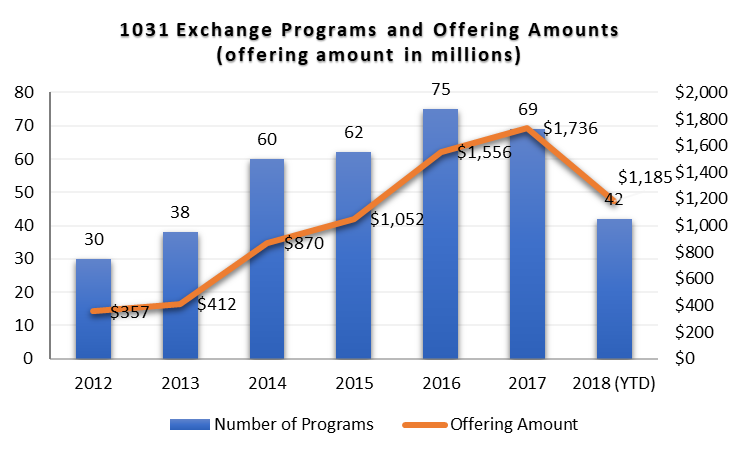

1031 Exchange Programs

- There were 10 new 1031 programs activated on the AI Insight platform in June for a total of $302.4 million in total offering amount, with 42 activated YTD as of the end of June for a total offering amount of $1,198.7 million.

- The aggregate June offering amount was well above May levels and YTD is approximately 68% above 2017 YTD levels.

- Inland Private Capital remains the top sponsor in the industry with 32% of the offering amount YTD. Passco Companies, LLC comes in at second with 12% of offering amount YTD, while the remainder of the programs were evenly spread between different sponsors.

- One new sponsor entered the market in June with one offering.

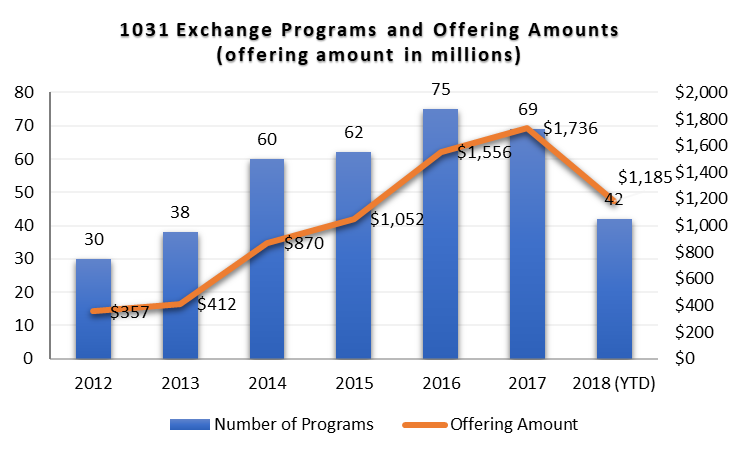

- Multifamily and net lease programs continue to dominate the space, with 60% and 13% of offering amounts YTD, respectively. Student housing represented just under 8% and healthcare represented approximately 5%.

- ON DECK: As of July 5th, two DST programs were activated in July with one coming soon.

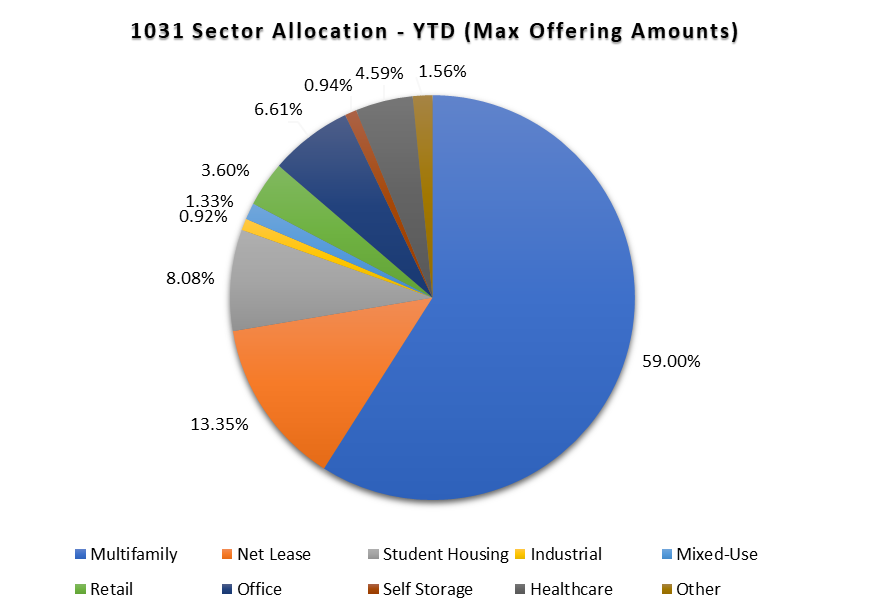

Energy

Energy

- Five energy focused programs were activated in June, for a total of nine programs YTD with $499.1 million in maximum offering amount.

- A large program focused on drilling activated in June, which puts the sector ahead of its 2017 run rate – a welcome sign after a few dismal years.

- Energy focused private placements are still well below their 2013-2014 peak, which corresponds with oil pricing trends. The entire energy industry has seen significant consolidation, debt reduction, and restructuring. It remains to be seen whether the private placement structure can thrive once again after all of these changes.

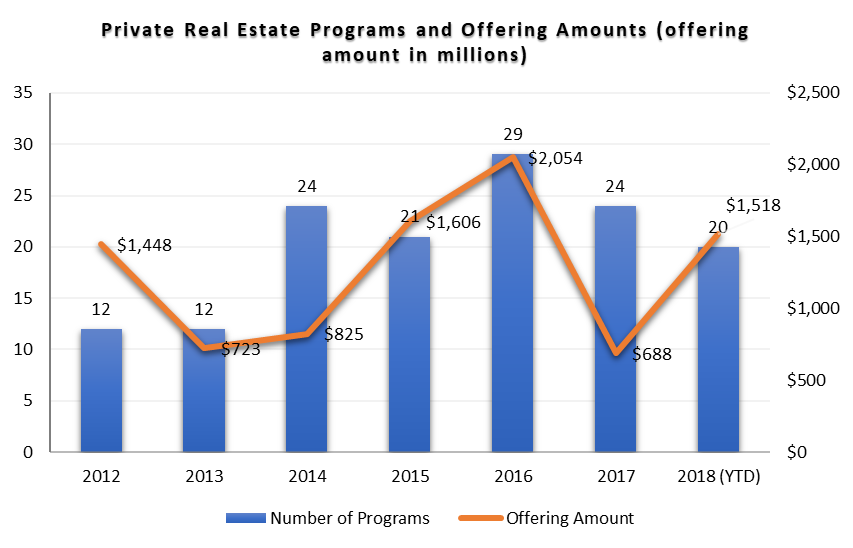

Real Estate

Real Estate

- 20 non-1031 real estate focused private placement programs have been activated on the AI Insight platform so far in 2018.

- As of June 30, 2018, the total maximum offering amount for real estate focused funds was over $1.5 billion, which more than doubles the total offering amount of $688 million for the full year 2017.

- ON DECK: As of July 5th, there was one non-1031 real estate private placement programs coming soon.

Other

Other

- One private equity program activated in June, bringing the total for private equity/debt programs to three for the year.

- Preferred programs are slightly below 2017 levels, with no new activations in June.

- Three conservation easement programs have activated so far in 2018, This is on par with 2017; however, the year was back-end heavy with 24 programs for $294 million offered between May and the end of 2017.

- One private non-traded REIT activated in June.

- ON DECK: As of July 5th, there was one hedge fund program coming soon.

| Glossary:

Activated: Program and education module are live on the AI Insight platform. Subscribers are able to view and download data for the program and take the education module. |

| Charts Source: AI Insight. Data as of June 30, 2018, based on programs activated on the AI Insight platform as of this date. |

Other

Other