Monday, February 24th, 2020 and is filed under AI Insight News

2019 was a record year for private placements on the AI Insight platform. Our December Private Placement Industry Report showed we added 200 new private placements to our coverage with an average target raise of $58.5 million, led by 1031s, opportunity zones and non-1031 real estate funds. We also reported that 158 private placements closed in 2019, having raised approximately 85% of their target.

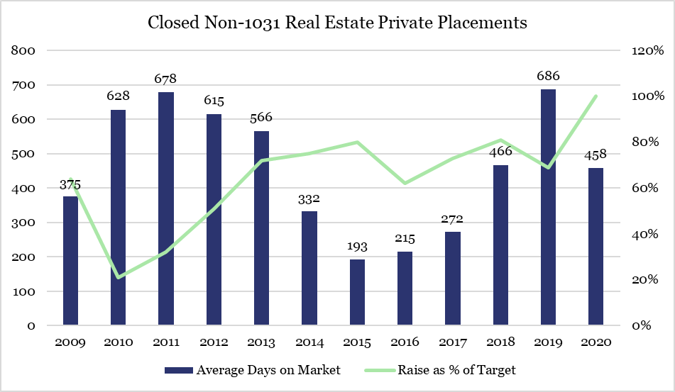

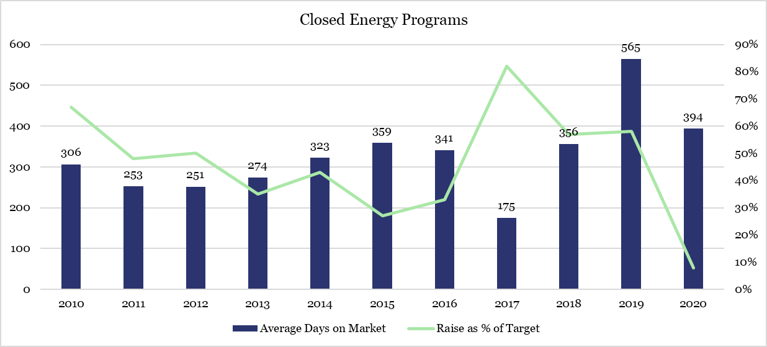

We recently analyzed the private placements on our platform that have closed to new investors since we started reporting in 2009 for a few statistics: (i) how long was the average fund within each category on the market (days on market), (ii) what was the average and range of capital raise targets and (iii) how close did the average fund come to meeting its capital raise target.

Overall, there are 987 funds on our platform that have closed to new investors since we started tracking data in 2009. The average target raise was $43.8 million, ranging from $800,000 to $4.1 billion. The average fund was on the market for 347 days and raised approximately 76% of its target.

Following is a closer look at some of the primary private placement categories. We report these and other statistics in our industry reports.

Private Real Estate

1031 Exchanges

Energy

Opportunity Zones

Other Resources

_________________________________

Charts and data based on programs activated on the AI Insight platform.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright ©2020 AI Insight. All Rights Reserved.