Real Estate Private Placement Fee Trends

Thursday, March 12th, 2020 and is filed under Industry Reporting

AI Insight currently covers 72 1031 exchange programs and 58 non-1031 real estate private placements. In our February 2020 Private Placement Industry Report, it shows that both categories are growing again in 2020, with 1031s continuing their record growth from the last couple of years.

We wanted to look at fees within both categories, from a current standpoint – what do fees look like now, and from a historical standpoint – have up-front selling commissions declined and have net proceeds increased?

Current Fees

To look at current fees, we utilized our Fee and Expense Report which compares fees on similar programs within our coverage universe. This report updates as programs close and new coverage is added. Below is a snapshot of programs raising capital as of March 9, 2020.

1031 Exchanges

- Up-front selling commission

- Industry Range: 5 – 6.55%

- Industry Average: 5.76%

- Net Proceeds (Before Acquisition Fees)

- Industry Range: 84.78 – 92.50%

- Industry Average: 90.11%

- Acquisition Fees and Expenses

- Industry Range: 0.16 – 13.25%

- Industry Average: 4.29%

- Liquidation Fees

- Industry Range: 1 – 8.50%

- Industry Average: 3.08%

Non-1031 Real Estate LPs and LLCs:

- Up-front selling commission

- Industry Range: 0 – 8%

- Industry Average: 5.49%

- Net Proceeds (Before Acquisition Fees)

- Industry Range: 86.50 – 98%

- Industry Average: 90.32%

- Acquisition Fees and Expenses

- Industry Range: 0 – 19%

- Industry Average: 2.74%

- Liquidation Fees

- Industry Range: 0 – 40%

- Industry Average: 7.98%

Historical Fees – Up-front Selling Commissions

Fees have always been a focus of regulatory concern, although up-front selling commissions have been at the forefront of regulatory scrutiny over the last decade. FINRA Regulatory Notice 15-02 required greater transparency into pricing including fees for direct participation programs and non-traded REITs. The DOL’s previously proposed Fiduciary Rule and now Regulation Best Interest, require financial professionals to carefully review and disclose the material fees and costs related to a client’s holdings.

With this in mind, we reviewed the data on our platform for the real estate private placements we covered over the last decade to see if there has been any change in the average up-front selling commissions and the average net proceeds (before acquisition fees, which includes up-front fees and expenses taken from offering proceeds) for these programs.

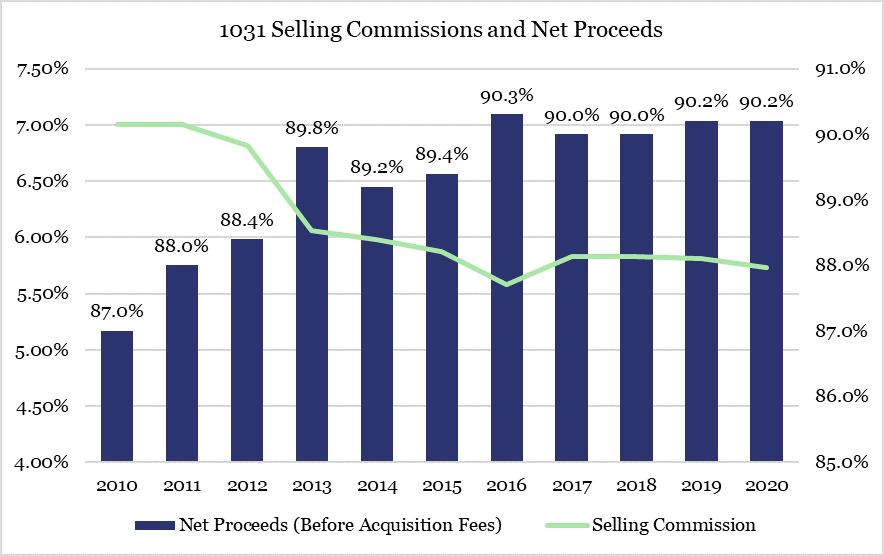

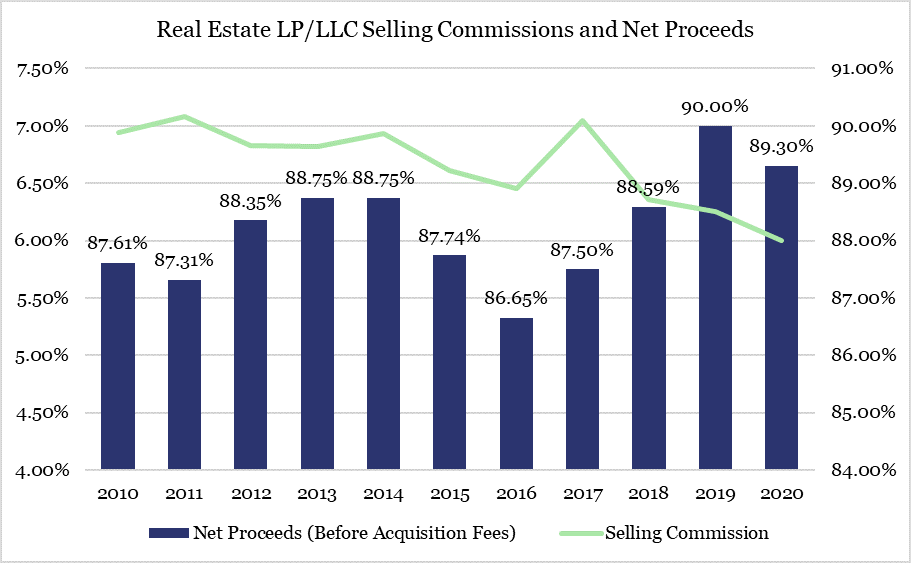

We found that up-front selling commissions have declined and net proceeds before acquisition fees has increased for 1031 exchanges and non-1031 real estate private placements over the last decade.

1031 selling commissions went from an average of 7% in 2010 to 5.73% for programs that opened in 2020, while the average net proceeds increased from 87 to 90.2%. This is a difference of approximately $3,200 on a $100,000 investment.

Results are similar for non-1031 real estate LPs and LLCs, with selling commissions declining from an average of 6.94% in 2010 to 6% in 2020. Net proceeds are up from 87.61% in 2010 to 89.30% in 2020 for a difference of $2,390 per $100,000 investment.

When looking at fees over time for real estate private placements, it appears the industry has responded to regulatory focus over the last decade by reducing up-front fees and expenses; even for private placements that may not be applicable to FINRA Regulatory Notice 15-02. However, real estate by its very nature can be an expensive asset class.

It is important to remember that although it may be good to see up-front fees decline, there are many other fees and expenses related to owning and operating direct real estate that must be considered reasonable including, but not limited to, construction costs, acquisition-related expenses, financing costs, leasing commissions, insurance and legal costs, and property management fees.