Tuesday, February 11th, 2020 and is filed under Industry Reporting

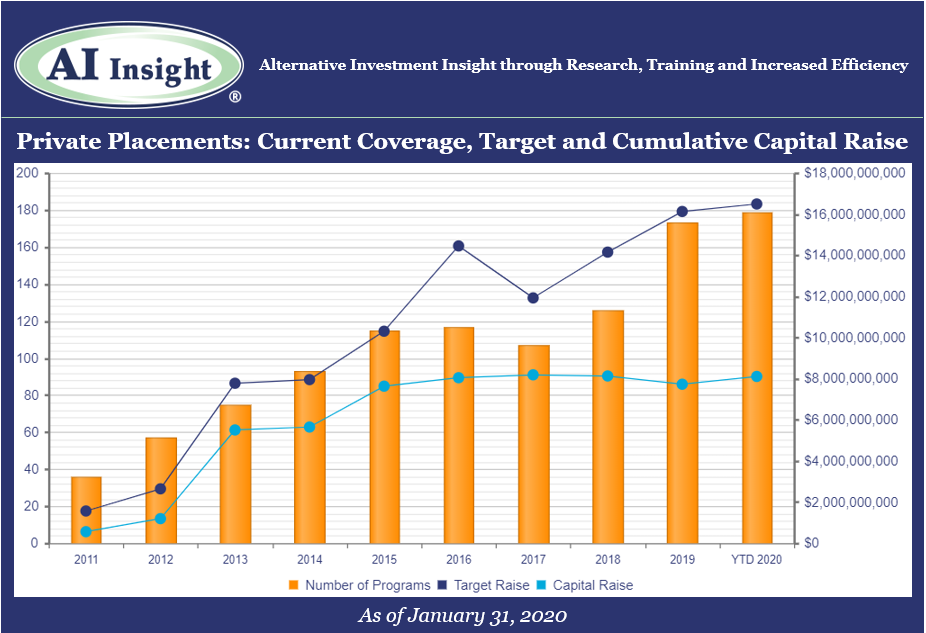

We recently released our January Private Placement Insights. See the highlights from the report below, or if you are a subscriber, log in now to see the entire report.

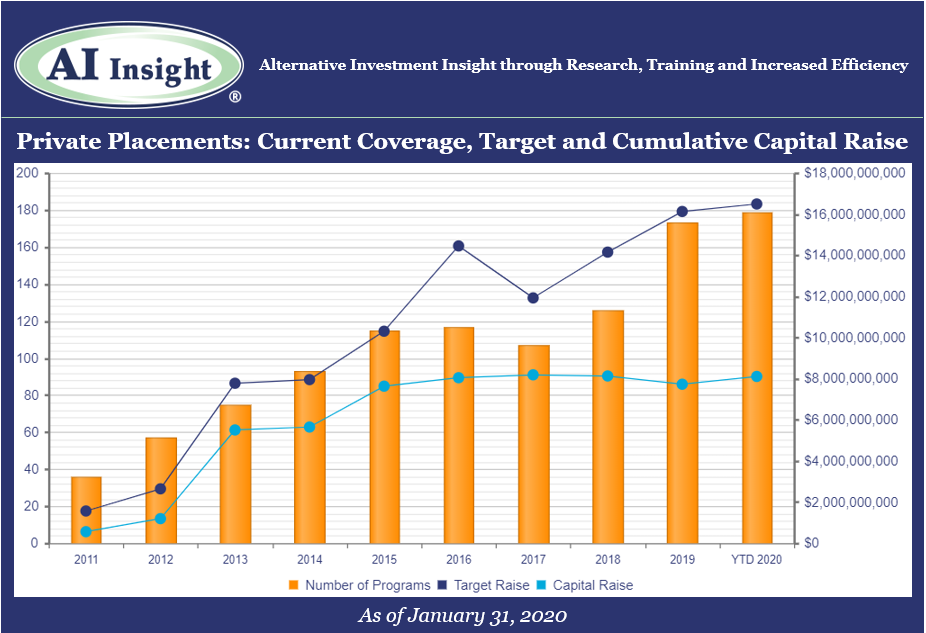

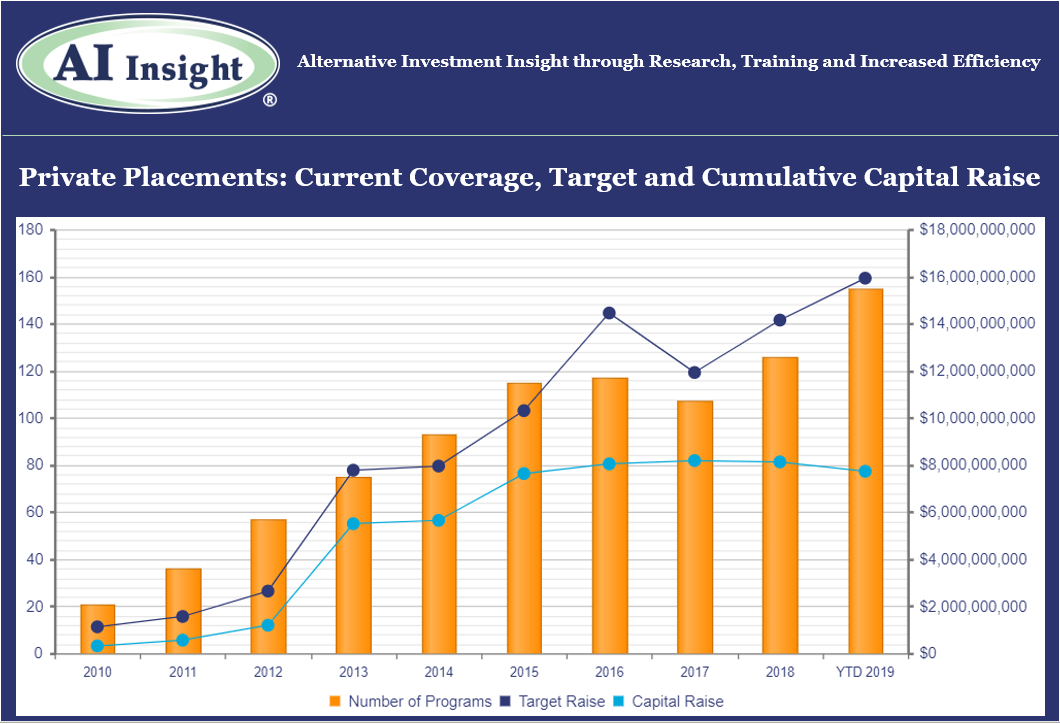

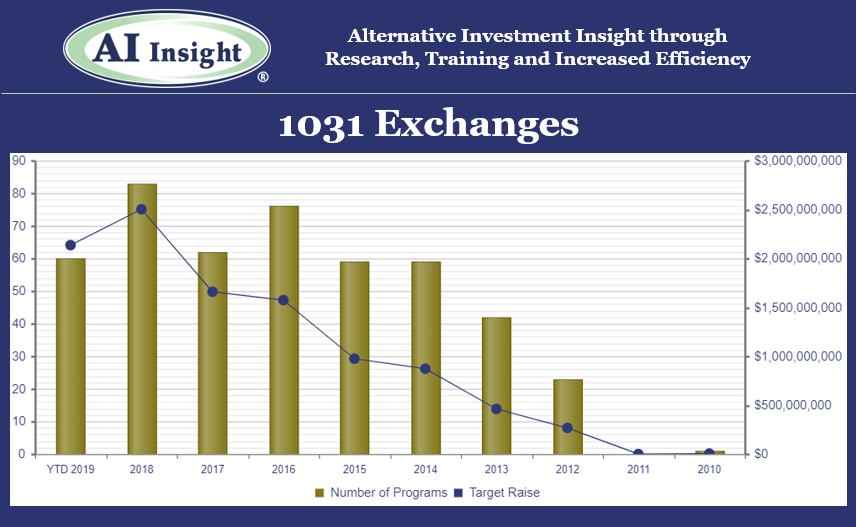

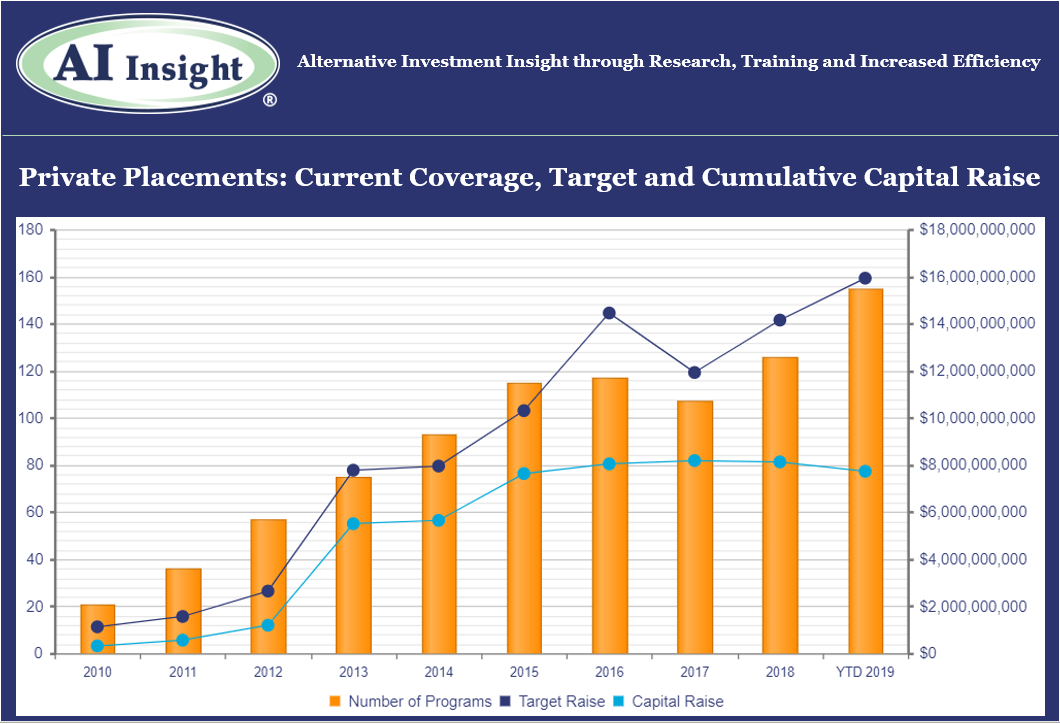

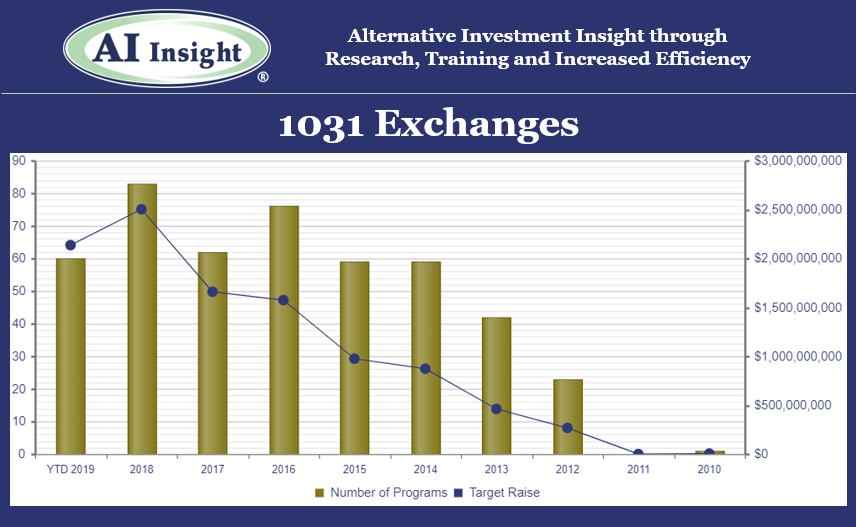

- 17 new private placements were added to our coverage in January, less than December’s record month, but higher on a year-over-year basis. The industry is again being led by 1031 exchanges, although target raise is higher than last year in all but one category.

- As of February 1st, AI Insight covers 179 private placements currently raising capital, with an aggregate target raise of $16.5 billion and an aggregate reported raise of $8.1 billion or 49% of target. The average size of the current funds is $92.1 million, ranging from $3.4 million for a single asset real estate fund to $2.2 billion for a sector specific private equity/debt fund.

- 13 private placements closed in January, having raised approximately 96% of their target.

- ON DECK: as of February 1st, there were 11 new private placements coming soon.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, BDCs, Closed-End Funds, and Alternative Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of Jan. 31, 2020, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright ©2020 AI Insight. All Rights Reserved.

Friday, January 24th, 2020 and is filed under Alternative Strategy Mutual Funds

If your firm approves all fund company mutual funds, additional due diligence may be needed based on continued regulatory guidance on alternative strategy mutual funds.

_________________________________________________________________________________________

Some financial firms have raised questions about the need for conducting additional research on alternative mutual funds given their complex structure compared to traditional mutual funds. Both FINRA and the SEC have published supporting regulatory detail to help differentiate the need for additional due diligence on alternative mutual funds.

How are you demonstrating your understanding of the complexities of alternative strategy mutual funds?

According to PwC’s recent report, Alternative asset management 2020-Fast forward to centre stage, “In the light of the attention from regulators, asset management firms should enter this new line of business well-prepared from a compliance and organisational standpoint. This includes:

- training

- assessing customer suitability

- marketing and education

- building out compliance and surveillance, and

- robust liquidity risk management.”

Take the first step. Let AI Insight help your firm:

1) Identify potential risk exposure

2) Determine due diligence needs

3) Establish policies and procedures around Alternative Strategy Mutual Funds

Contact us for a complimentary Risk Exposure Analysis to see if your firm may need to conduct additional due diligence on alternative strategy mutual funds.

Related Regulatory References

Training Resources

Monday, January 13th, 2020 and is filed under AI Insight News

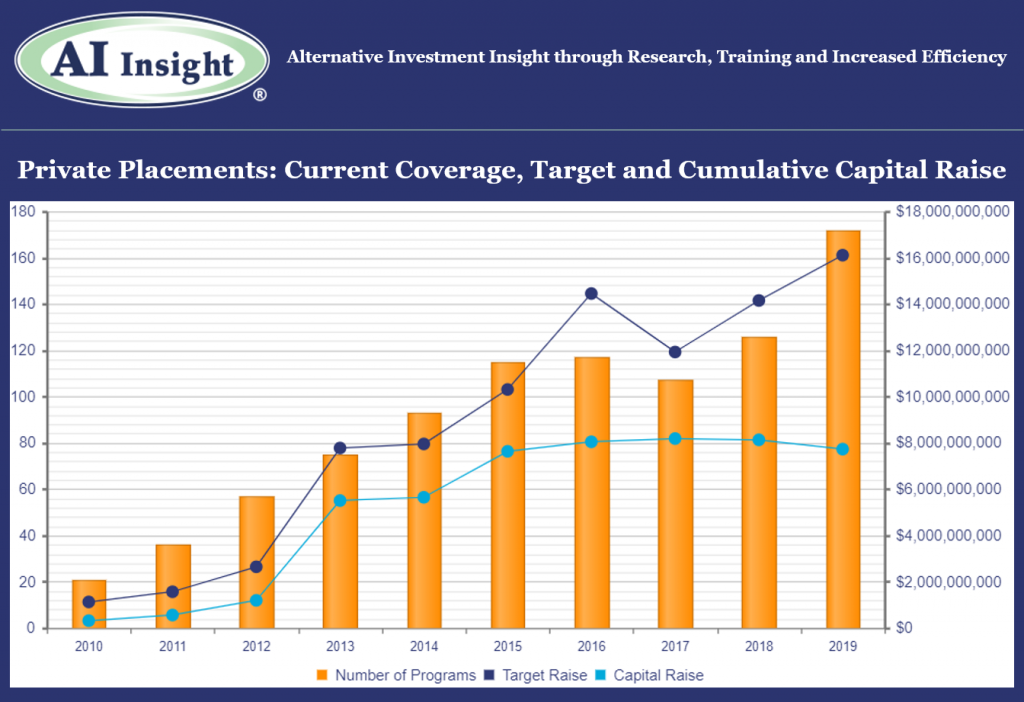

We recently released our December Private Placement Insights. See the highlights from the report below, or if you are a subscriber, log in now to see the entire report.

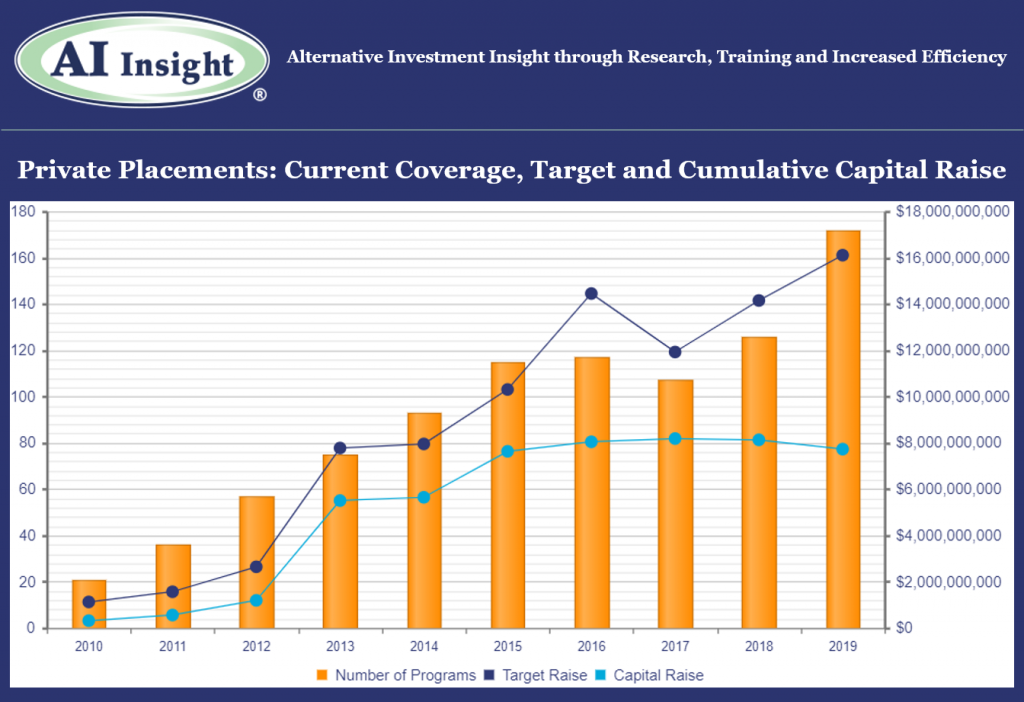

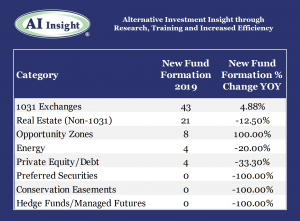

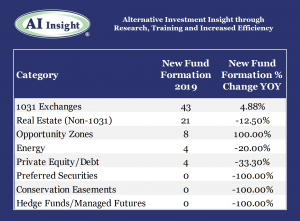

- More private placements were added to our coverage in 2019 than ever before with record months in November and December. The 200 private placement funds added during the year were slightly smaller in overall target raise than 2018, with the aggregate just 1.3% above last year despite the increased number of funds.

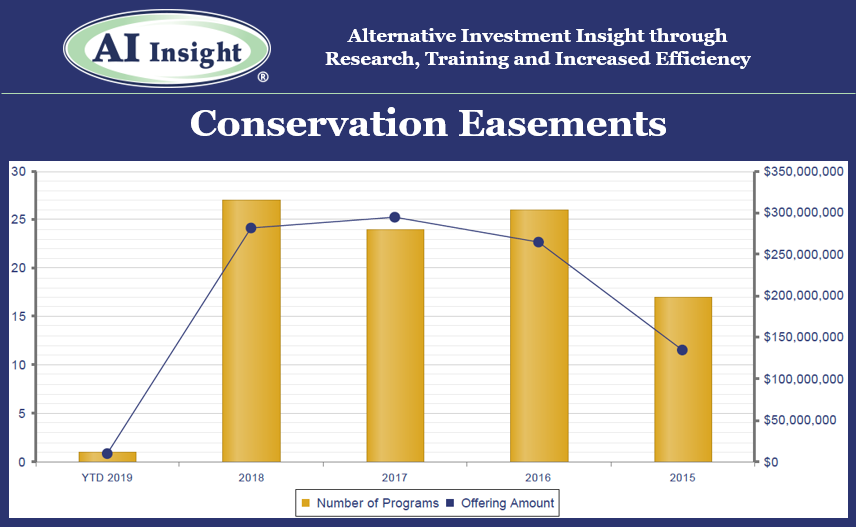

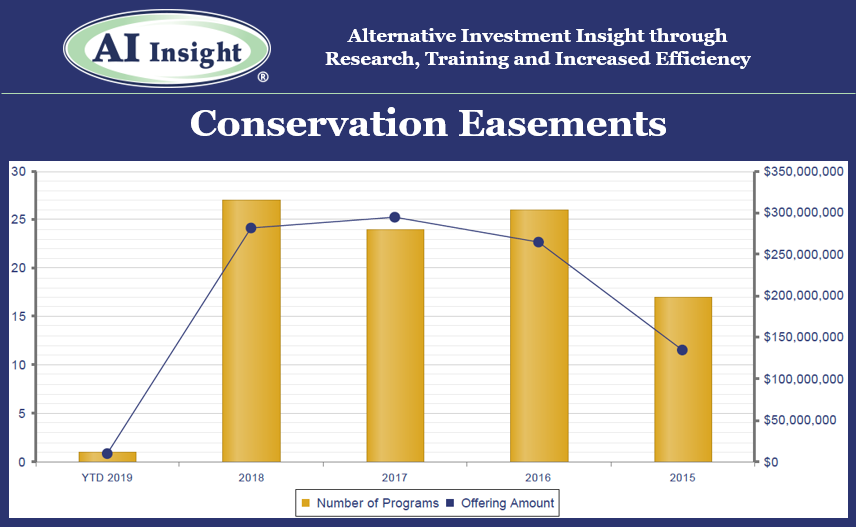

- The industry was led primarily by continued growth in 1031 exchanges and the addition of Opportunity Zone funds. Private equity/debt activity picked up late in the year, as did conservation contributions and energy funds. Other real estate, which includes non-1031 real estate LLCs and LPs trailed, with fund sizes significantly smaller than in prior years.

- As of January 1st, AI Insight covers 172 private placements currently raising capital, with an aggregate target raise of $16.1 billion and an aggregate reported raise of $7.7 billion or 48% of target. The average size of the current funds is $93.2 million, ranging from $3.4 million for a single asset fund to $2.2 billion for a sector specific private equity/debt fund.

- 158 private placements closed in 2019, having raised approximately 85% of their target.

- ON DECK: as of January 1st, there were eight new private placements coming soon.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, BDCs, Closed-End Funds, and Alternative Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of Dec. 31, 2019, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright ©2020 AI Insight. All Rights Reserved.

Friday, December 6th, 2019 and is filed under AI Insight News

Be proactive about internet security risks and unauthorized data access that can impact clients and your business.

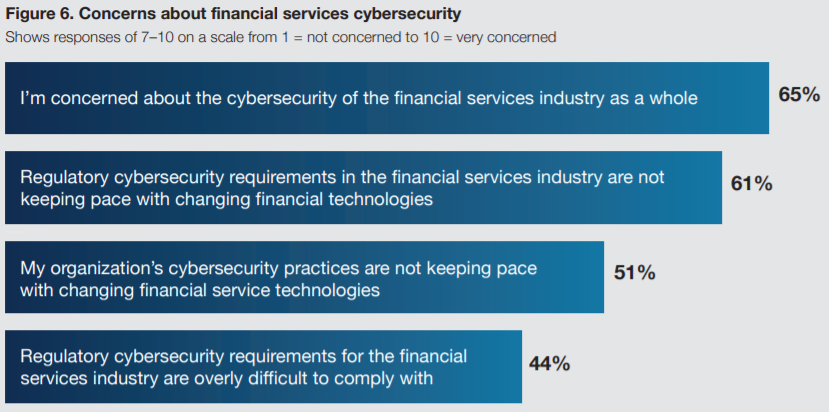

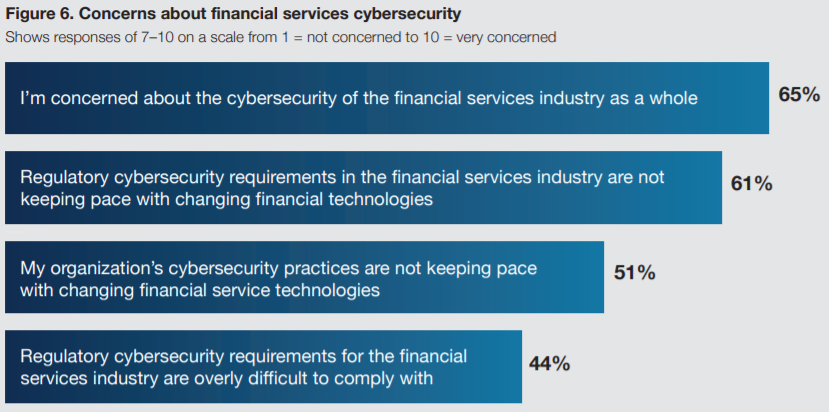

The financial services industry is certainly aware of potential security vulnerabilities and risks. While protections are in place, cybersecurity isn’t keeping pace with the technology advances in the financial services industry according to “The State of Software Security in the Financial Services Industry”. The survey conducted as part of the report also shows that 65% of respondents are concerned with complying with cybersecurity requirements.

Source: The State of Software Security in the Financial Services Industry

How does your firm compare?

The research report was commissioned by the Synopsys Cybersecurity Research Center (CyRC) and conducted by the Ponemon Institute. It includes a survey of over 400 IT security practitioners in various sectors of the financial services industry, including banking, insurance, mortgage lending/processing, and brokerage.

Read the detailed survey results here to see how your firm compares, including:

- The software security posture of financial services companies

- Risks to financial software and applications

- Security practices in the design and development of financial service software and technologies

How regulators look at cybersecurity and key strategies to be compliant

Not only is data security a concern, but regulators have also taken interest in cybersecurity risks that may impact financial firms. Below are five things every regulator looks for during an audit:

- Risk Register

- Framework and Assessment of the Security Program

- Strategy and Roadmap

- Incident Response Plan

- Governance & Centralized Management

7 security tips for financial firms

Take a look at 7 security tips for financial firms to learn about steps you can take such as training, establishing policies and securing devices to help lessen your security risks. The first tip recommends employee training, which the Ponemon Institute study mentions is often not mandated within organizations.

AI Insight collaborated with Docupace Technologies, LLC and Beacon Strategies, LLC to develop a CE Course, “Cybersecurity Awareness for Financial Professionals” to help you better understand the regulatory focus on cybersecurity, the threat landscape and practical things you can do to protect client data. This course is eligible for 1 credit toward the CFP® and other designations. Learn more

Friday, November 8th, 2019 and is filed under AI Insight News

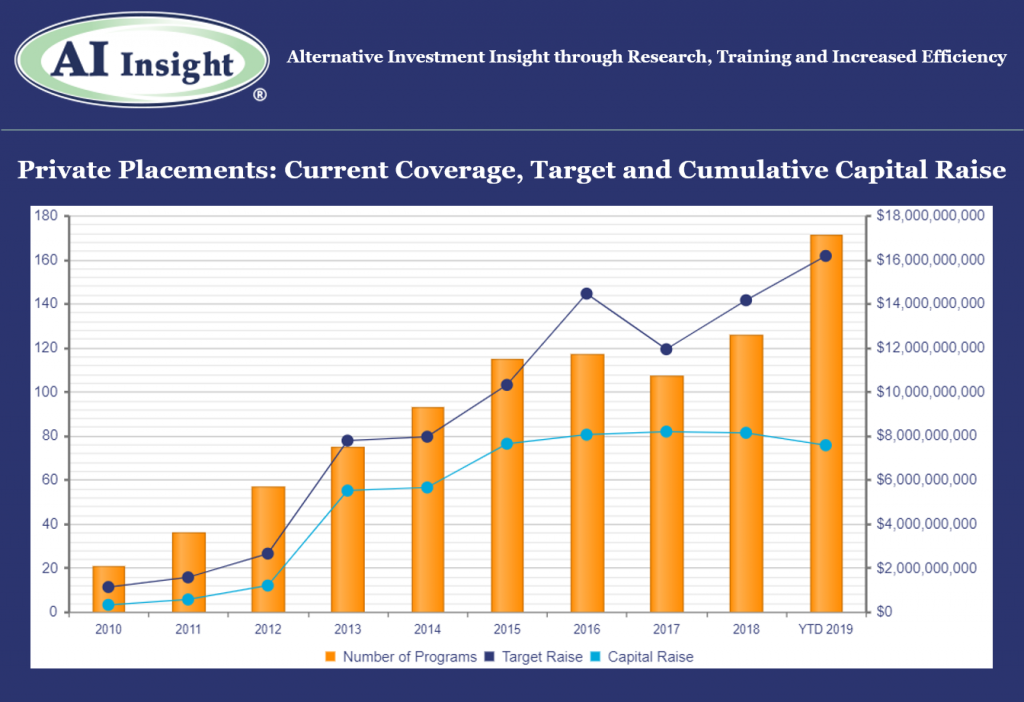

We recently released our October Private Placement Insights. Highlights from the report include:

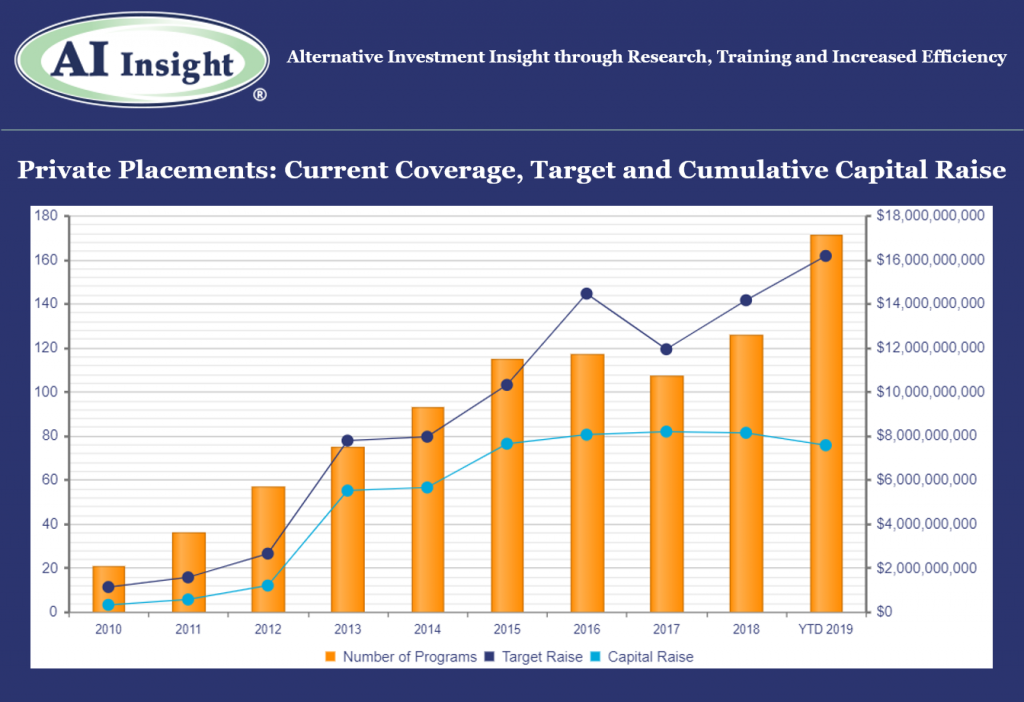

- October private placement activity picked up after a slow September, primarily in the 1031 category.

- Our overall private placement coverage is up year-over-year in terms of new fund coverage and aggregate target raise, led primarily by 1031s and Opportunity Zones, while most other categories remain below last year’s levels.

- Our coverage of hedge funds and managed futures has not expanded in 2019. We discussed this in our September Private Placements podcast. We believe the minimal activity in the hedging and futures space can be attributable to a few factors. One is that funds and fund-of-funds used by many retail firms tend to be larger with a perpetual life that have been around for many years and used as needed. Allocations to hedging and futures strategies also tend to be smaller in the retail channel than the institutional side, so fewer options are available and many use liquid alternatives for these allocations, where we have seen a lot of growth and increased coverage in recent years. Additionally, the strong equity market over the last decade has minimized the focus on hedging and futures strategies.

- As of November 1st, AI Insight covers 171 private placements currently raising capital, with an aggregate target raise of $16.2 billion and an aggregate reported raise of $7.6 billion or 46.9% of target. This includes the 147 private placements added to our coverage in 2019.

- As of November 1st, 111 private placements have closed year-to-date which raised approximately 86% of their target raise. While there are still two months remaining, funds this year have come closer to their targets than last year, when the 160 private placements that closed in FY 2018 raised approximately 63% of their target.

Access the full Private Placements report and other hard-to-find alts data

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, BDCs, Closed-End Funds, and Alternative Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

_________________________________

Chart and data as of Oct. 31, 2019, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright © 2019 AI Insight. All Rights Reserved.

Monday, October 14th, 2019 and is filed under AI Insight News

We recently released our September Private Placement Insights. Highlights from the report include:

- September private placement fund formation was the slowest of the year, coming off of a strong August.

- Given the slower pace in September, our private placement coverage is essentially flat year-over-year, with all categories down in terms of new fund coverage and target raise except 1031 exchanges and Opportunity Zone funds.

- As of September 30th, AI Insight covers 155 private placements that are currently raising capital, with an aggregate target raise of $15.9 billion and an aggregate reported raise of $7.7 billion or 51.5% of target. This includes the 120 private placements added to our coverage in 2019.

- As of September 30th, 87 private placements have closed year-to-date which raised approximately 92% of their target raise, compared to 160 private placements that closed in FY 2018 which raised approximately 63% of their target.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, BDCs, Closed-End Funds, and Alternative Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews. Click here to request a sample report.

Watch this tour or request a live demo of AI Insight’s expansive Industry Reports customized to your business needs.

_________________________________

Chart and data as of Sept. 30, 2019, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright © 2019 AI Insight. All Rights Reserved.

Wednesday, September 18th, 2019 and is filed under AI Insight News

We recently released our August Private Placement Insights. Highlights from the report include:

- As of August 31st, AI Insight covers 164 private placements that are currently raising capital, with an aggregate target raise of $11.5 billion and an aggregate reported raise of $7.3 billion. This includes the 114 private placement funds added to our coverage in 2019.

- 1031 exchanges continue to expand. This is understandable given the long-term run in commercial real estate prices, as investors look to capture gains and defer taxes.

- There were 10 new 1031s added to our coverage in August, with an aggregate target raise of $339.4 million. This is higher than the prior month, and the category remains ahead YoY in terms of new fund formations and aggregate target raise.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, BDCs, Closed-End Funds, and Alternative Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews. Click here to request a sample report.

Watch this tour or request a live demo of AI Insight’s expansive Industry Reports customized to your business needs.

_________________________________

Chart and data as of August 31, 2019, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright © 2019 AI Insight. All Rights Reserved.

Thursday, August 15th, 2019 and is filed under AI Insight News

We recently released our July Private Placement Insights. Highlights from the report include:

- AI Insight added 14 new private placements added to our coverage in July.

- This included one new Conservation Easement, the first one added this year.

- This niche strategy is down for the year, along with energy and preferred offerings strategies.

- Conservation Easements have been in somewhat of a hold period due to heightened IRS scrutiny of the appraisal methods used to calculate deductions, as well as the uncertainty over the allegations against one of the industry’s largest sponsors.

- ON DECK: As of August 8th, there is one more conservation easement program coming soon, offered by the same sponsor as the first.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, BDCs, Closed-End Funds, and Alternative Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews. Click here to request a sample report.

Watch this tour or request a live demo of AI Insight’s expansive Industry Reports customized to your business needs.

_________________________________

Chart and data as of July 31, 2019, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright © 2019 AI Insight. All Rights Reserved.

Tuesday, July 16th, 2019 and is filed under AI Insight News

We recently released our June Private Placement Insights. AI Insight currently covers 154 private funds that are raising capital, representing over $5 billion in capital raise/AUM. This includes 14 new private placements added to our coverage in June. Highlights from the report include:

- 2019 fund formation overall is on par with 2018. Target raise is lower = smaller average fund size.

- Real estate funds continue to dominate the private placement space.

- 43 new 1031 exchanges and 21 new non-1031 real estate funds have been added to our coverage in 2019.

- 8 qualified opportunity zone funds have been added in 2019 with more coming soon. However, raise is slow, with the funds reporting an aggregate raise of 11.9% of target.

- Other niche strategies (energy, conservation easements, preferred offerings) are down for the year.

Log in or subscribe to AI Insight to further research, sort, compare, and analyze all of the private and public funds in our coverage universe. See who’s new in the industry and what trends are impacting the alts space.

AI Insight’s Industry Reporting capabilities help you review alternative investment trends and historical market data for Private Placements, Non-Traded REITs, BDCs, Closed-End Funds, and Alternative Mutual Funds. Receive up to 24 extensive reports per year to help broaden your alternative investment reviews.

Watch this tour or request a live demo of AI Insight’s expansive Industry Reports customized to your business needs.

_________________________________

Chart and data as of June 30, 2019, based on programs activated on the AI Insight platform as of this date.

Activated means the program and education module are live on the AI Insight platform. Subscribers can view and download data for the program and access the respective education module.

On a subscription basis, AI Insight provides informational resources and training to financial professionals regarding alternative investment products and offerings. AI Insight is not affiliated with any issuer of such investments or associated in any manner with any offer or sale of such investments. The information above does not constitute an offer to sell any securities or represent an express or implied opinion on or endorsement of any specific alternative investment opportunity, offering or issuer. This report may not be shared, reproduced, duplicated, copied, sold, traded, resold or exploited for any purpose. Copyright © 2019 AI Insight. All Rights Reserved.