Are you doing enough to protect client data?

Friday, December 6th, 2019 and is filed under AI Insight News

Be proactive about internet security risks and unauthorized data access that can impact clients and your business.

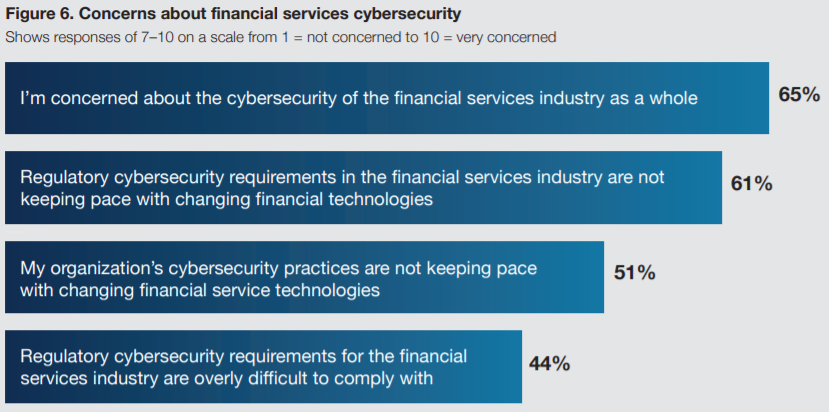

The financial services industry is certainly aware of potential security vulnerabilities and risks. While protections are in place, cybersecurity isn’t keeping pace with the technology advances in the financial services industry according to “The State of Software Security in the Financial Services Industry”. The survey conducted as part of the report also shows that 65% of respondents are concerned with complying with cybersecurity requirements.

Source: The State of Software Security in the Financial Services Industry

How does your firm compare?

The research report was commissioned by the Synopsys Cybersecurity Research Center (CyRC) and conducted by the Ponemon Institute. It includes a survey of over 400 IT security practitioners in various sectors of the financial services industry, including banking, insurance, mortgage lending/processing, and brokerage.

Read the detailed survey results here to see how your firm compares, including:

- The software security posture of financial services companies

- Risks to financial software and applications

- Security practices in the design and development of financial service software and technologies

How regulators look at cybersecurity and key strategies to be compliant

Not only is data security a concern, but regulators have also taken interest in cybersecurity risks that may impact financial firms. Below are five things every regulator looks for during an audit:

- Risk Register

- Framework and Assessment of the Security Program

- Strategy and Roadmap

- Incident Response Plan

- Governance & Centralized Management

7 security tips for financial firms

Take a look at 7 security tips for financial firms to learn about steps you can take such as training, establishing policies and securing devices to help lessen your security risks. The first tip recommends employee training, which the Ponemon Institute study mentions is often not mandated within organizations.

AI Insight collaborated with Docupace Technologies, LLC and Beacon Strategies, LLC to develop a CE Course, “Cybersecurity Awareness for Financial Professionals” to help you better understand the regulatory focus on cybersecurity, the threat landscape and practical things you can do to protect client data. This course is eligible for 1 credit toward the CFP® and other designations. Learn more