2019 FINRA Priorities Letter – Focus on Private Placements and Suitability

Friday, February 1st, 2019 and is filed under AI Insight News

FINRA recently issued its 2019 Risk Monitoring and Examination Priorities Letter along with its 2018 Examinations Finding Report. These reports highlight, among other things, the continued focus on client suitability and overconcentration in non-traded investments, and the need for reasonable due diligence for private placements that is well documented.

Specifically, the 2019 Priorities Letter states,

“As always, suitability will remain one of FINRA’s top priorities. This year, some of the specific areas on which we may focus include: (1) deficient quantitative suitability determinations or related supervisory controls; (2) overconcentration in illiquid securities, such as variable annuities, non-traded alternative investments and securities sold through private placements; and (3) recommendations to purchase share classes that are not in line with the customer’s investment time horizon or hold for a period that is inconsistent with the security’s performance characteristics…”

The 2018 Findings Report stated,

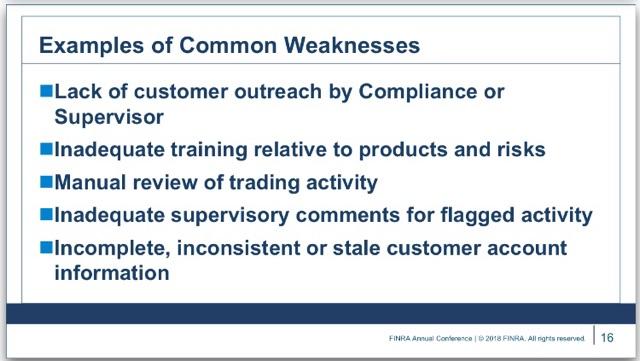

“FINRA has observed instances where some firms that have suitability obligations under FINRA Rule 2111 (Suitability) failed to conduct reasonable diligence on private placements and failed to meet their supervisory requirements under FINRA Rule 3110 (Supervision). FINRA Regulatory Notice 10-22 describes the circumstances under which firms have an obligation to conduct a “reasonable investigation” by evaluating “the issuer and its management; the business prospects of the issuer; the assets held by or to be acquired by the issuer; the claims being made; and the intended use of proceeds of the offering.”

Additionally, in the 2018 Findings Report, FINRA outlines the characteristics of firms that have performed reasonable due diligence, and reminds firms conducting due diligence of their obligation to document both the “process and results” of such reasonable due diligence analysis.

Key Takeaways

- Carefully review and understand the specific suitability requirements for each non-traded or private placement program utilized, and ensure that your firm has a documented process in place to monitor the compliance with suitability requirements.

- Perform a “reasonable investigation” of all complex products, focusing on the specific factors outlined by FINRA in the 2018 Findings Report. For further guidance on what constitutes a “reasonable investigation,” review FINRA Regulatory Notice 10-22.

- Document the due diligence process – remember, if it isn’t documented, it was never done.

- If utilizing third party due diligence vendors, ensure that your firm independently investigates any red flags identified, and document your firm’s investigation and findings.

Let AI Insight help you stay Compliant

- Unbiased education: Access product-specific training on the features, risks and suitability for hundreds of offerings.

- Conduct research: Create efficiencies in your due diligence review process using our robust database to source new products as well as analyze and compare hundreds of alternative investment programs, including non-traded programs, private placements, and alternative mutual funds.

- Compliance documentation: Demonstrate what you’re doing to support your firm’s regulatory requirements in a transparent way. AI Insight captures all of the activity your firm members complete within the platform including training modules, offering document reviews and research conducted.

Resources

- 2019 Risk Monitoring and Examination Priorities Letter and Podcast

- 2018 Examinations Finding Report

- Suitability for Retail Customers

- December Private Placements Insights

- Alternatives are complex. Here’s how to make sense of them for clients.

- Do you know your regulatory responsibility?

- Request a live tour of AI Insight customized to your business needs