Monday, April 21st, 2014 and is filed under AI Insight News

The real challenge holding many firms back from expanding their alternative investment platform is meeting advisor education and advisor training requirements per FINRA NTM 03-71, 05-26, 10-22, and 12-03

Though there is no clear definition of just what makes an investment “alternative,” most financial professionals consider any investment that falls outside the realm of traditional publicly traded equities and bonds to be alternative investments. The SEC groups private equity funds, venture capital funds, real estate funds, and structured products under the alternative heading. The common denominator is that these investments are able to provide some hedge against downturns in more traditional investments in an investor’s portfolio.

Given the drastic stock market downturns of the early 2000’s and 2008, it is easy to see why more investors are actively seeking alternative products. A recent MainStay Investment survey found that 67 percent of high net worth investors reported using alternative investments, and these investors agree that alternative investments will become more important and mainstream over the next five years.

To meeting rising demand, many independent broker dealers are looking to add alternatives despite facing continually increasing compliance requirements. While much of the industry focus falls squarely on due diligence both before and after a program is added to the BD’s platform, due diligence is really just the tip of the iceberg when it comes to compliance.

Regulators caution that alternative investments are much more difficult for investors, and even advisors, to understand. Because these products are complex and are gaining popularity, FINRA and the SEC are intensely focused on alternative investment education.

Thus, the real challenge holding many firms back from expanding their alternative investment platform is meeting advisor education and training requirements per FINRA NTM 03-71, 05-26, 10-22, and 12-03. Firms have a responsibility not only to provide educational materials to advisors, but also must be able to provide demonstrable proof advisors accessed and understood these materials. Faced with the prospect of having to create or adopt compliant testing materials – not to mention the logistical issues associated with record-keeping, some firms find they simply don’t have the resources and must forego adding alternative investment opportunities.

AI Insight has a solution that allows broker-dealers to confidently expand their platform quickly and easily.

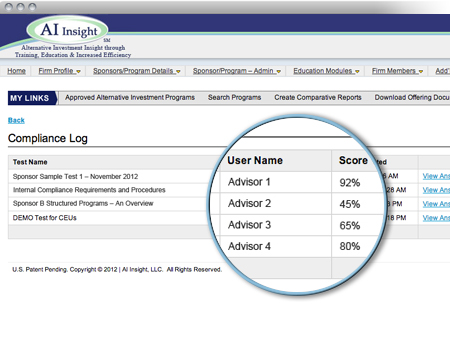

AI Insight’s PPM/Prospectus-based education modules are designed by compliance professionals, and are fully customizable to each independent broker-dealer’s standards and preferences. Best of all, the AI Insight system automatically stores all advisor training activity in the firm’s compliance log which can be accessed whenever and wherever it is needed.

AI Insight takes the complexity out of managing advisor education on alternative investments. Contact us today for your introduction to the AI Insight system!